Out-of-Pattern Take a look at of Components Investing Methods

Can we simplify the complexities of the inventory market and distill them right into a easy set of quantifiable metrics? A variety of tutorial papers counsel this, and so they provide formulation that ought to make the lifetime of a inventory picker simpler. A few of the most compelling methodologies inside this realm are the F-Rating, Magic Components, Acquirer’s A number of, and the Conservative Components. These quantitative methods are designed to determine undervalued shares with sturdy fundamentals and potential for top returns. However do they actually work out-of-sample? A brand new paper by Marcel Schwartz and Matthias X. Hanauer tries to reply this fascinating query…

Components investing isn’t only a sport of probability; it’s a methodical pursuit grounded in monetary rules and financial theories. The F-Rating, developed by Professor Joseph Piotroski, makes use of 9 standards to evaluate an organization’s monetary power, offering a complete snapshot of its viability. Joel Greenblatt’s Magic Components targets shares with excessive earnings yields and excessive returns on capital, simplifying the stock-picking course of. The Acquirer’s A number of, however, focuses on money flows and earnings earlier than curiosity and taxes, providing a singular perspective on valuation. Lastly, the Conservative Components, emphasizing capital preservation and danger administration, gives a balanced method to investing.

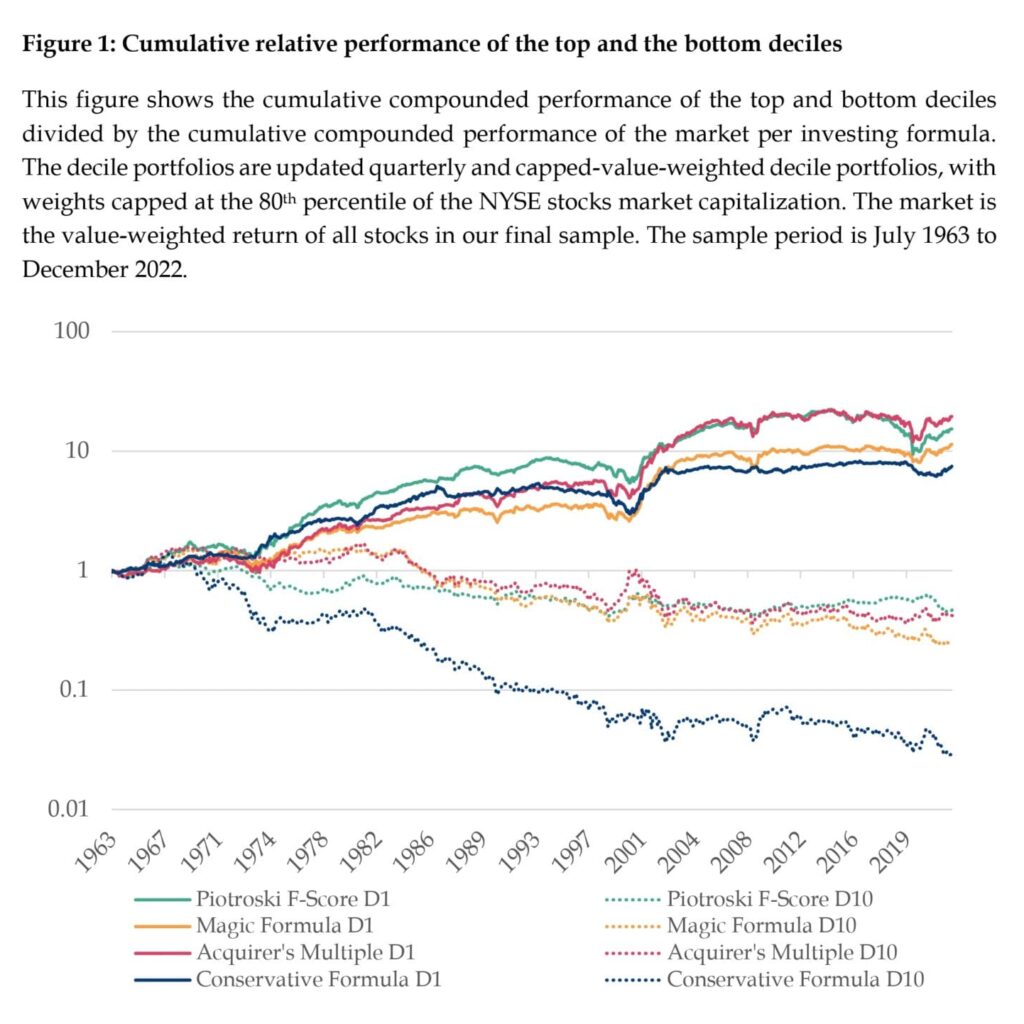

Featured examine evaluates the effectiveness of those 4 standard investing formulation over an intensive interval from 1963 to 2022 for the U.S. market. The findings point out that every formulation generates important uncooked and risk-adjusted returns, outperforming the market primarily by offering environment friendly publicity to worth and high quality elements. The Conservative Components is probably the most distinct technique, providing optimistic momentum publicity and persistently low volatility, making it probably the most defensive technique among the many 4. The examine confirms that each one formulation exhibit predictive energy within the cross-section of inventory returns. Nevertheless, no single formulation persistently dominates throughout totally different efficiency metrics.

The Acquirer’s A number of achieves the best returns for top-decile portfolios, whereas the Conservative Components leads in CAPM alpha and return unfold. After adjusting for established asset pricing elements, the Magic Components shows the best remaining alpha.

The Magic Components and Conservative Components are notably efficient within the post-2000 interval, particularly in concentrated long-only portfolios.

The Magic Components demonstrates sturdy efficiency with reasonable danger, attaining the best uncooked returns among the many formulation for capped-value-weighted portfolios. Conversely, the Conservative Components excels in risk-adjusted efficiency, with the bottom most draw-down and a notably low beta.

In comparison with the prevailing literature, the examine’s findings align with earlier analysis on the profitability of those formulation. All formulation proceed to generate market out-performance, though the returns are usually decrease than the unique findings, primarily because of the exclusion of microcaps, the inclusion of out-of-sample years, and methodological variations. The examine demonstrates that formula-based investing can nonetheless generate market out-performance, offering traders with environment friendly publicity to well-documented issue premiums. These methods thus provide comparatively easy-to-implement choices for traders but in addition require investor self-discipline as these methods might underperform within the quick time period. Because the effectiveness of those formulation has weakened lately, findings additionally point out the significance of steady innovation in investing methods.

Authors: Marcel Schwartz and Matthias X. Hanauer

Title: Components Investing

Hyperlink: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=5043197

Summary:

This examine evaluates the effectiveness of 4 standard investing formulation—the F-Rating, Magic Components, Acquirer’s A number of, and Conservative Components—inside a unified framework over an intensive interval. Every formulation generates important uncooked and risk-adjusted returns, primarily by offering environment friendly publicity to well-established model elements. Nevertheless, no single formulation persistently outperforms throughout all metrics. The Acquirer’s A number of achieves the best returns for high decile portfolios, the Conservative Components leads in CAPM alpha and return unfold, and the Magic Components reveals the best remaining alpha after adjusting for frequent elements. Whereas all formulation stay profitable for concentrated long-only portfolios within the post-2000 interval, we observe some efficiency decay relative to earlier intervals, underscoring the necessity for steady innovation in investing methods.

As normal, we current a number of satisfying figures and tables:

Notable quotations from the educational analysis paper:

“Our important findings are summarized as follows. First, we discover that each one formulation result in near-monotonically rising returns when sorting shares into decile portfolios. Because of this, the highest portfolios outperform each the market and the underside portfolios. Moreover, the top-minus-bottom portfolios exhibit important annual uncooked returns starting from 5.6% to six.4%, whereas the CAPM alphas vary from 7.0% to 12.2%. Whereas the formulation present sturdy efficiency over the total pattern, in addition they exhibit intervals of pronounced underperformance and indications of efficiency decay within the post-2000 interval. Second, factor-spanning assessments reveal that the formulation obtain this outperformance primarily by offering environment friendly publicity to established asset pricing elements resembling worth, profitability, and momentum. Third, concentrated long-only portfolios of the 40 top-ranked formulation shares additionally outperform the market within the post-2000 interval, each when it comes to uncooked and risk-adjusted returns. Nevertheless, all investing formulation undergo from substantial relative drawdowns through the 2018-2020 interval. Lastly, we doc that no single investing formulation dominates throughout all efficiency analysis metrics. Within the decile evaluation, the Acquirer’s A number of reveals the best return for the highest portfolio, whereas the Conservative Components has the best top-minus-bottom return and CAPM alpha unfold. Conversely, the Magic Components achieves the best remaining alpha when controlling for frequent asset pricing elements. For concentrated capped-value-weighted portfolios of 40 shares within the post-2000 interval, the Magic and Conservative Formulation provide the best uncooked and risk-adjusted efficiency, respectively.

Lastly, the investigated funding formulation are comparatively straightforward to implement, which distinguishes them from extra advanced and complex fashions, resembling machine-learning prediction fashions, which have turn into standard lately, cf., Rasekhschaffe and Jones (2019), Gu et al. (2020) or Hanauer and Kalsbach (2023). Though these extra advanced fashions usually present increased gross returns (cf., Blitz et al. 2023a), in addition they entail increased turnover and transaction prices. Furthermore, traders might encounter extra funding boundaries, together with restricted entry to the mandatory knowledge, lacking infrastructure to course of the information, or the lack to execute the ensuing alerts in a well timed and environment friendly method (cf., Blitz et al. 2023b). These extra refined fashions current subsequently solely real alternatives for these traders who’re in a position to overcome these challenges. In distinction, the investigated investing formulation present traders with environment friendly publicity to established issue premiums and are comparatively straightforward to implement.

The complete-sample interval consists of just about 60 years of information, and we are going to check for consistency over time. Determine 1 shows the cumulative compounded efficiency of the highest and backside deciles divided by the cumulative compounded efficiency of the market per investing formulation.10

Proof from the earlier long-short analyses signifies that the formulation have predictive energy on inventory returns. Nonetheless, this normal tutorial method requires shorting, and the outcomes over time additionally revealed a weakening of alphas after 2000. Subsequently, we apply a “do-it-yourself” perspective on all 4 formulation.Desk 3 presents the efficiency abstract statistics for concentrated long-only portfolios of the 40 top-ranked shares per investing formulation, each for capped-value-weighted and equally-weighted portfolios from January 2000 to December 2022.11 The outcomes reveal a number of key insights into the effectiveness and danger profiles of every formulation. We all the time begin with the outcomes for the value-weighted portfolios and point out variations for the equal-weighted portfolios.”

Are you in search of extra methods to examine? Join our publication or go to our Weblog or Screener.

Do you need to study extra about Quantpedia Premium service? Test how Quantpedia works, our mission and Premium pricing provide.

Do you need to study extra about Quantpedia Professional service? Test its description, watch movies, evaluation reporting capabilities and go to our pricing provide.

Are you in search of historic knowledge or backtesting platforms? Test our listing of Algo Buying and selling Reductions.

Or observe us on:

Fb Group, Fb Web page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookDiscuss with a buddy