By Manusha Rao

Pre-requisites for studying from this weblog:

https://weblog.quantinsti.com/python-programming/

2. https://weblog.quantinsti.com/set-up-python-system/

3. https://weblog.quantinsti.com/python-data-structures/

4. https://weblog.quantinsti.com/python-data-types-variables-tutorial/

Stage of your weblog: Intermediate

Python is broadly used to develop buying and selling algorithms on account of its intensive ecosystem of libraries tailor-made to finance and buying and selling.

On this article, we cowl just a few broadly used Python libraries for quantitative buying and selling, categorized by their performance. Listed below are the Python libraries that we are going to talk about on this weblog:

Fetching information

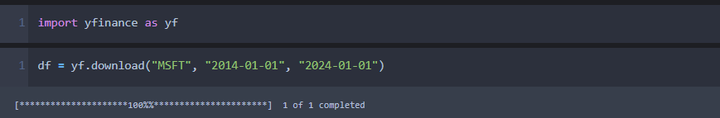

yfinance

yfinance (Yahoo Finance) is a Python library used to fetch monetary information, historic value information, basic information, real-time market info, and so forth. immediately from Yahoo Finance. It offers merchants, buyers, and researchers a straightforward solution to entry and analyze monetary market information.

Set up

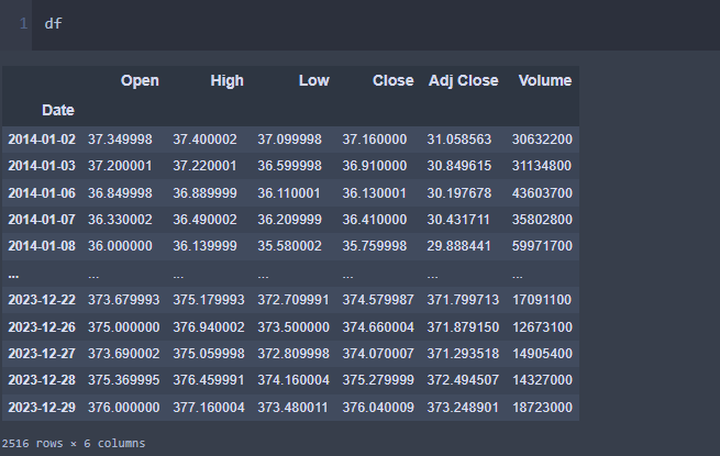

Information obtain for a single inventory

Output

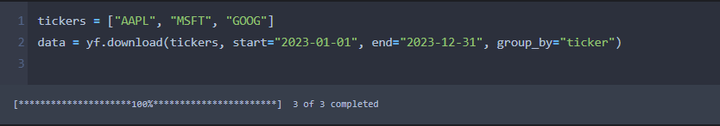

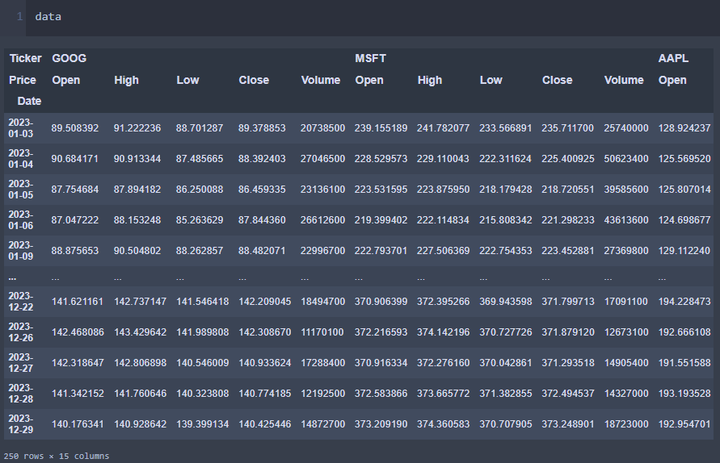

Information obtain for a number of shares

Output

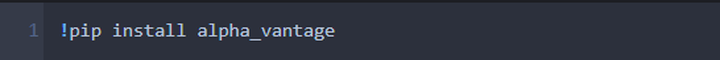

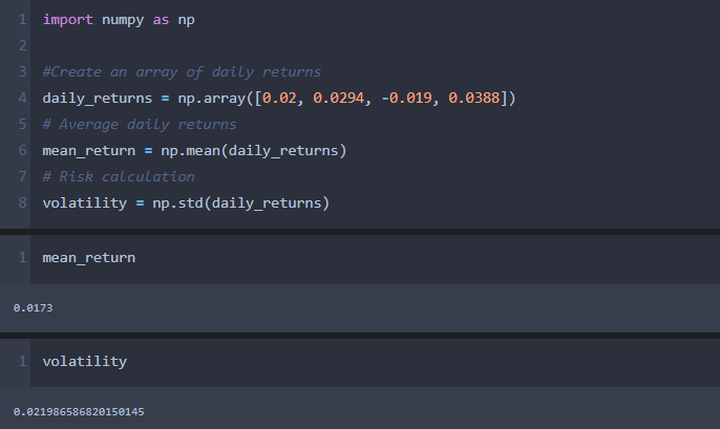

2. Alpha Vantage

Alpha Vantage is one other Python library that helps receive historic value and basic information by way of the Alpha Vantage API. You want an API key to make use of it. Join on their official web site to get a free API key. An extra bonus is that it gives technical indicator information corresponding to SMA, EMA, MACD, and Bollinger Bands.

Set up

Information obtain and output

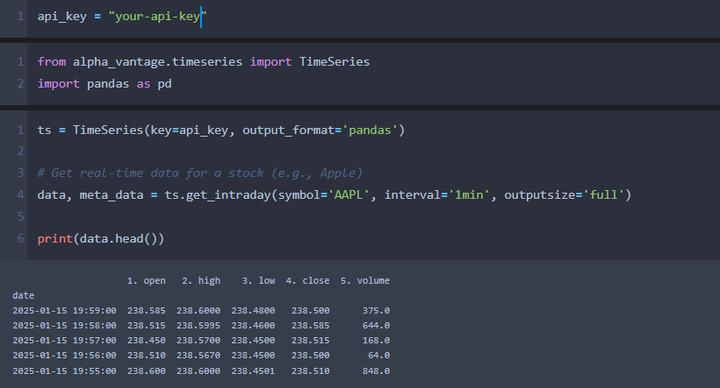

3. Pandas-DataReader

Pandas-DataReader lets you extract Federal Reserve Financial Information, Fama French Information, World Financial institution Growth Indicators, and so forth. You possibly can entry the checklist of the info sources right here.

Set up

Information obtain

IBridgePy

IBridgePy is an easy-to-use Python library that can be utilized to commerce with Interactive Brokers. It’s a wrapper, particularly a Python wrapper, that gives a user-friendly interface to work together with the Interactive Brokers API, offering a easy answer whereas hiding IB’s complexities. IBridgePy helps Python to name IB’s C++ API immediately because it acts as a wrapper. Right here is an instance of easy methods to obtain the info.

Information manipulation

The next libraries are primarily used for math and information operations.

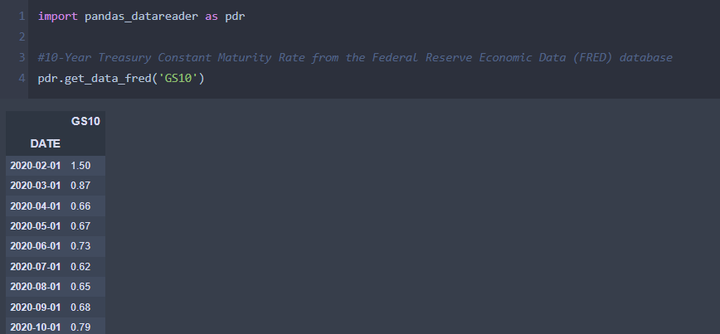

1. NumPy

NumPy (Numerical Python) is an open-source Python library that gives environment friendly operations for numerical computing. It handles giant datasets, performs mathematical operations, and works with multi-dimensional arrays and matrices. Key options of this library embody:

N-dimensional arraysMathematical functionsVectorized operationsBroadcastingRandom quantity generationLinear algebra

Set up

Statistical evaluation

2. Pandas

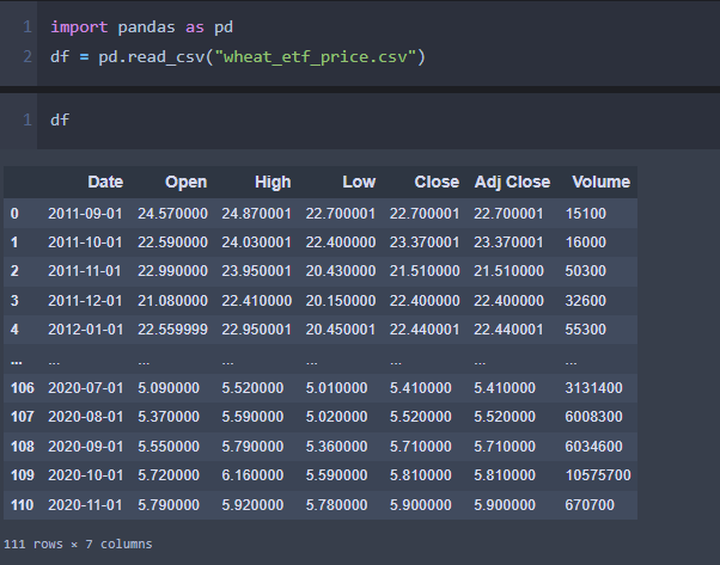

The Pandas library is broadly used for information manipulation and evaluation, particularly with structured information. It offers easy-to-use information constructions like DataFrame and Collection for dealing with numerous information codecs. Beneath are the important thing options of the Pandas library:

Information structuresHandling lacking dataData dealing with and manipulationVectorised operations, and so forth.

Set up

Learn value information from a csv file

Technical evaluation

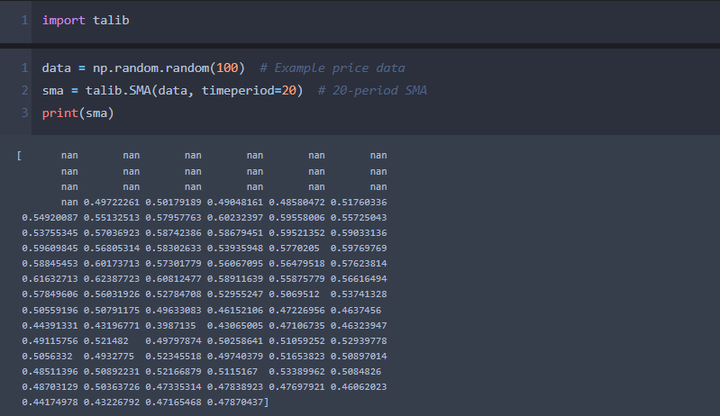

1. TA-Lib

TA-Lib is an open-source library used to carry out technical evaluation on monetary information utilizing technical indicators corresponding to RSI (Relative Energy Index), Bollinger bands, MACD, and so forth. These indicators assist the algorithmic dealer to create a method primarily based on the findings.

Set up

Rolling easy shifting common calculation

Plotting and visualization

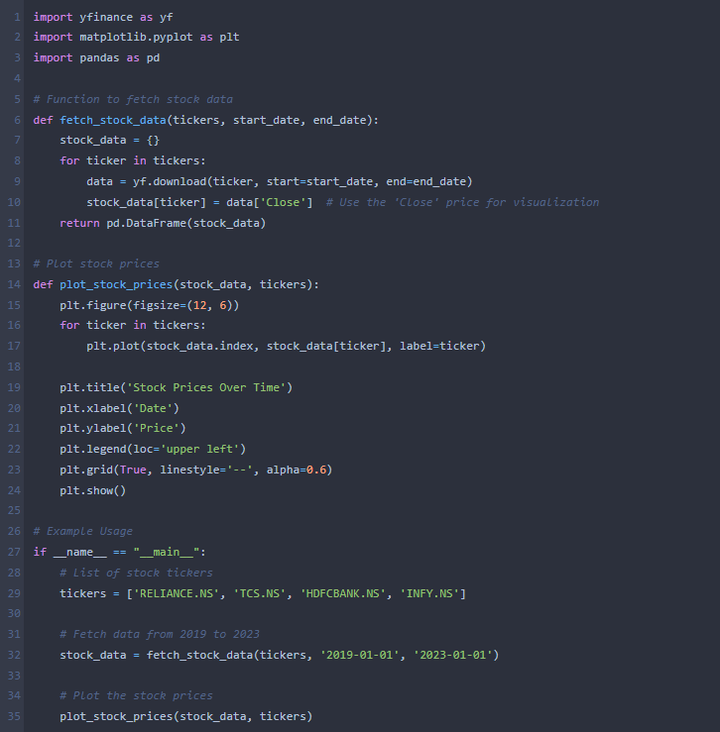

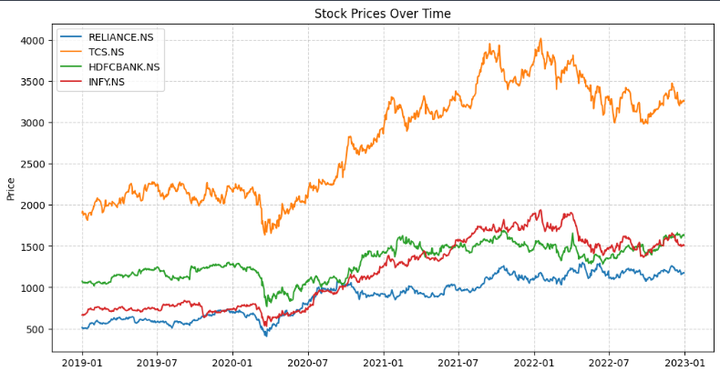

Matplotlib

Matplotlib is a Python library that plots 2D constructions like graphs, charts, histograms, scatter plots, and so forth. Just a few of the features of matplotlib include-

Scatter (for scatter plots)Pie (for pie charts)Stackplot (for stacked space plot)Colorbar (so as to add a colour bar to the plot) and so forth.

Set up

Plotting shut costs of shares

2. Plotly

Plotly is a Python library that interactively helps in information visualization. Plotly was created so as to add to the options of matplotlib. It helps to make the info extra significant by having interactive charts and plots.

The Plotly Python library consists of the next packages:

plotly: Major bundle that incorporates all of the performance.

graph_objs: Accommodates objects or templates of figures used for visualizing.

matplotlib: Helps matplotlib figures as properly.

Set up

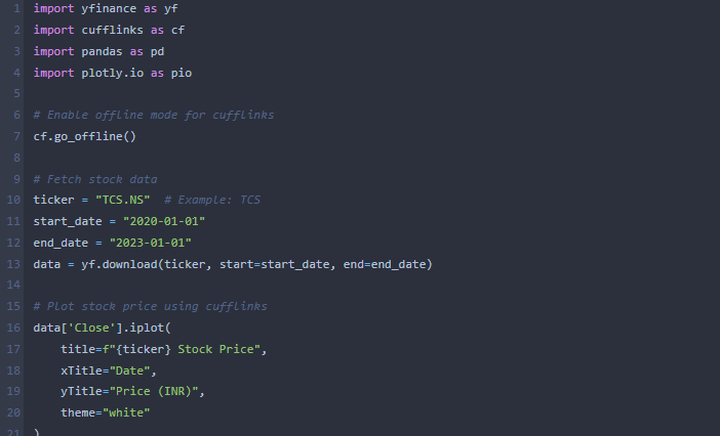

Plotting inventory value

Cufflinks offers a bridge between Pandas DataFrames and Plotly, enabling seamless plotting.

Make sure that cufflinks library is put in utilizing “!pip set up cufflinks”

As you may see from the determine under, there are numerous instruments (marked in purple) particularly; zoom, hover, pan, autoscale reset axes, and so forth to make y our plots extra interactive and user-friendly.

Backtesting

We backtest Python buying and selling algorithms utilizing historic market information to evaluate their efficiency and validate their effectiveness earlier than deploying them in stay buying and selling environments. Backtesting helps merchants optimize parameters, mitigate dangers, and refine their buying and selling methods over time. The next Python libraries can be utilized in buying and selling for backtesting.

1. Backtrader

Backtrader is an open-source Python library that you should use for backtesting, technique visualization, and live-trading. Though it’s fairly potential to backtest your algorithmic buying and selling technique in Python with out utilizing any particular library, Backtrader offers many options that facilitate this course of. Each advanced part of peculiar backtesting may be created with a single line of code by calling particular features.

For these exploring algo buying and selling, instruments like Backtrader simplify backtesting and technique growth, making it simpler to experiment and refine buying and selling methods successfully.

2. Vectorbt

vectorbt is a Python library designed for backtesting, optimizing, and analyzing buying and selling methods. It leverages the facility of NumPy and Pandas for extremely environment friendly computation, making it appropriate for large-scale monetary information and complicated methods. It’s notably helpful for quantitative buying and selling, providing a light-weight but sturdy framework.

Machine studying

1. Scikit-learn

Scikit-learn is a machine studying library constructed upon the SciPy library that consists of assorted algorithms, together with classification, clustering, and regression, that can be utilized together with different Python libraries like NumPy and SciPy for scientific and numerical computations. A few of its courses and features are:

sklearn.clustersklearn.datasetssklearn.ensemblesklearn.combination

2. TensorFlow

TensorFlow is an open-source software program library for high-performance numerical computations and machine studying functions, corresponding to neural networks. As a result of its versatile structure, TensorFlow permits simple computation deployment throughout numerous platforms, corresponding to CPUs, GPUs, TPUs, and so forth.

This is a information to putting in TensorFlow GPU in Python.

3. Keras

Keras is a deep studying library to develop neural networks and different deep studying fashions. Moreover, Keras may be put in in your system and constructed on high of TensorFlow, or Microsoft Cognitive Toolkit, which focuses on being modular and extensible. It consists of the weather used to construct neural networks corresponding to layers, targets, optimizers, and so forth. This library can be utilized in buying and selling for inventory value prediction utilizing Synthetic Neural Networks.

To recap all the important thing factors we have mentioned, please seek advice from the desk under for a complete overview.

Class

Library

Goal

Set up

Instance Utilization

Fetching Information

yfinance

Fetch historic costs and fundamentals from Yahoo Finance

pip set up yfinance

yf.obtain(“AAPL”, begin=”2022-01-01″, finish=”2022-12-31″)

Alpha Vantage

Fetch historic costs, fundamentals, and technical indicators

pip set up alpha_vantage

ts.get_daily(image=”AAPL”, outputsize=”full”)

Pandas-DataReader

Fetch historic and various monetary information (FRED, World Financial institution, and so forth.)

pip set up pandas-datareader

internet.DataReader(“AAPL”, “yahoo”, begin, finish)

IBridgePy

Hook up with Interactive Brokers for information fetching and stay buying and selling

Guide setup from IBridgePy

Information Manipulation

NumPy

Carry out mathematical operations on multi-dimensional arrays

pip set up numpy

np.imply(np.array([1, 2, 3]))

Pandas

Manipulate tabular and time-series information

pip set up pandas

pd.DataFrame({‘A’: [1, 2, 3]})

Technical Evaluation

TA-Lib

Use technical indicators (RSI, Bollinger Bands, MACD, and so forth.)

pip set up TA-Lib

talib.RSI(np.random.random(100))

Plotting & Visualization

Matplotlib

Plot graphs, charts, and histograms

pip set up matplotlib

plt.plot([1, 2, 3], [4, 5, 6])

Plotly

Create interactive visualizations

pip set up plotly

px.line(data_frame, x=’x_col’, y=’y_col’)

Backtesting

Backtrader

Backtest and visualize buying and selling methods

pip set up backtrader

cerebro.addstrategy(MyStrategy)

Vectorbt

Excessive-performance backtesting and optimization utilizing NumPy and Pandas

pip set up vectorbt

portfolio = vbt.Portfolio.from_signals(shut, entries, exits)

Machine Studying

Scikit-learn

Apply ML algorithms like classification, clustering, and regression

pip set up scikit-learn

mannequin = sklearn.linear_model.LinearRegression()

TensorFlow

Construct and deploy machine studying fashions (e.g., neural networks)

pip set up tensorflow

tf.keras.Sequential([…])

Keras

Construct deep studying fashions (simplified interface for TensorFlow)

pip set up keras

keras.Sequential([…])

The panorama of Python buying and selling libraries gives highly effective instruments for buyers and algorithmic merchants. From information evaluation with Pandas to machine studying capabilities in scikit-learn, and specialised monetary libraries like IbridgePy and Backtraderr, builders have sturdy frameworks to construct subtle buying and selling methods. The bottom line is deciding on libraries that align together with your particular buying and selling objectives, whether or not quantitative evaluation, backtesting, stay buying and selling, or advanced algorithmic approaches.

Subsequent steps:

1. https://weblog.quantinsti.com/python-pandas-tutorial/

2. https://weblog.quantinsti.com/python-numpy-tutorial-installation-arrays-random-sampling/

3. https://weblog.quantinsti.com/trading-using-machine-learning-python/

4. https://weblog.quantinsti.com/python-matplotlib-tutorial/

5. https://weblog.quantinsti.com/install-ta-lib-python/

6. https://weblog.quantinsti.com/backtrader/