Up to date on February 14th, 2025 by Bob Ciura

DRIP stands for Dividend Reinvestment Plan. When an investor is enrolled in DRIP shares, it signifies that incoming dividend funds are used to buy extra shares of the issuing firm – robotically.

Many companies supply DRIPs that require the traders to pay charges. Clearly, paying charges is a unfavourable for traders. As a common rule, traders are higher off avoiding DRIP shares that cost charges.

Fortuitously, many corporations supply no-fee DRIP shares. These permit traders to make use of their hard-earned dividends to construct even bigger positions of their favourite high-quality, dividend-paying corporations – totally free.

The Dividend Champions are a bunch of high quality dividend shares which have raised their dividends for a minimum of 25 consecutive years.

You may obtain your free copy of the Dividend Champions listing, together with related monetary metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the hyperlink under:

Take into consideration the highly effective mixture of DRIPs and Dividend Champions…

You’re reinvesting dividends into an organization that pays greater dividends yearly. Because of this yearly you get extra shares – and every share is paying you extra dividend revenue than the earlier 12 months.

This makes a robust (and cost-effective) compounding machine.

This text takes a have a look at the highest 15 Dividend Champions which might be no-fee DRIP shares, ranked so as of anticipated complete returns from lowest to highest.

The up to date listing for 2025 consists of our prime 15 Dividend Champions, ranked by anticipated returns in line with the Positive Evaluation Analysis Database, that provide no-fee DRIPs to shareholders.

You may skip to evaluation of any particular person Dividend Champion under:

Moreover, please see the video under for extra protection.

#15: UGI Corp. (UGI)

5-year anticipated annual returns: 8.2%

UGI Company is a gasoline and electrical utility that operates in Pennsylvania, along with a big vitality distribution enterprise that serves your complete US and different elements of the world.

It was based in 1882 and has paid consecutive dividends since 1885. Its market capitalization is $6.2 billion. The corporate operates in 4 reporting segments: AmeriGas, UGI Worldwide, Midstream & Advertising and marketing, and UGI Utilities.

On November 22, 2024, UGI Company reported document outcomes for fiscal 2024, attaining an all-time excessive adjusted diluted EPS of $3.06, pushed by sturdy execution of strategic priorities and effectivity enhancements.

The corporate realized a $75 million discount in working bills forward of schedule, attaining everlasting price financial savings focused for fiscal 2025.

UGI additionally returned $320 million to shareholders by dividends, persevering with a 140-year streak of consecutive dividend funds and demonstrating a five-year EPS CAGR of 6%.

Key accomplishments included vital investments in infrastructure, with $500 million allotted to utility enhancements and the completion of the Moody RNG venture, anticipated to provide 300 MMCF yearly.

Click on right here to obtain our most up-to-date Positive Evaluation report on UGI (preview of web page 1 of three proven under):

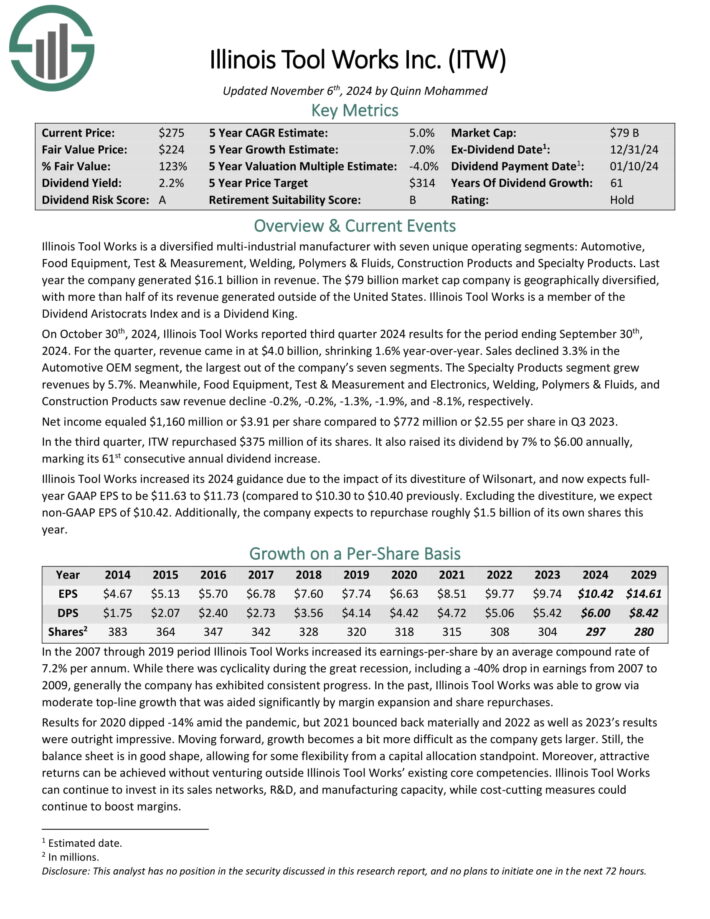

#14: Illinois Device Works (ITW)

5-year anticipated annual returns: 6.5%

Illinois Device Works is a diversified multi-industrial producer with seven distinctive working segments: Automotive, Meals Gear, Take a look at & Measurement, Welding, Polymers & Fluids, Building Merchandise and Specialty Merchandise.

Final 12 months the corporate generated $16.1 billion in income.

On October thirtieth, 2024, Illinois Device Works reported third quarter 2024 outcomes for the interval ending September thirtieth, 2024. For the quarter, income got here in at $4.0 billion, shrinking 1.6% year-over-year. Gross sales declined 3.3% within the Automotive OEM phase, the biggest out of the corporate’s seven segments.

The Specialty Merchandise phase grew revenues by 5.7%. In the meantime, Meals Gear, Take a look at & Measurement and Electronics, Welding, Polymers & Fluids andConstruction Merchandise noticed income decline -0.2%, -0.2%, -1.3%, -1.9%, and -8.1%, respectively.

Web revenue equaled $1,160 million or $3.91 per share in comparison with $772 million or $2.55 per share in Q3 2023. Within the third quarter, ITW repurchased $375 million of its shares. It additionally raised its dividend by 7% to $6.00 yearly, marking its 61st consecutive annual dividend improve.

Click on right here to obtain our most up-to-date Positive Evaluation report on ITW (preview of web page 1 of three proven under):

#13: Tompkins Monetary (TMP)

5-year anticipated annual returns: 7.6%

Tompkins Monetary is a regional monetary providers holding firm headquartered in Ithaca, NY that may hint its roots again greater than 180 years. It has complete property of about $8 billion, which produce about $300 million in annual income.

The corporate gives a variety of providers, together with checking and deposit accounts, time deposits, loans, bank cards, insurance coverage providers, and wealth administration to its prospects in New York and Pennsylvania.

Tompkins additionally sports activities a 38-year dividend improve streak after boosting its payout for November 2024.

Tompkins posted fourth quarter and full-year earnings on January thirty first, 2025, and outcomes had been considerably blended.

Earnings-per-share got here in 15 cents forward of estimates at $1.37. Income was up greater than 8% year-over-year to $77.1 million, however missed estimates by about 1%.

Web curiosity margin for the fourth quarter was 2.93%, up from 2.79% within the third quarter, and up from 2.82% a 12 months in the past.

Whole common price of funds was 1.88% for This autumn, down 13 foundation factors from Q3 as funding combine and decrease rates of interest each contributed.

Click on right here to obtain our most up-to-date Positive Evaluation report on TMP (preview of web page 1 of three proven under):

#12: Northrop Grumman (NOC)

5-year anticipated annual returns: 8.0%

Northrop Grumman Company is among the main protection shares.

It studies 4 enterprise segments: Aeronautics Programs (plane and UAVs), Mission Programs (radars, sensors and methods for surveillance and concentrating on), Protection Programs (sustainment and modernization, directed vitality, tactical weapons), and House Programs (missile protection, area methods, hypersonics and area launchers).

Northrop Grumman makes the B-2 Spirit, E-2D, E-8C, RQ-4 World Hawk, MQ-4C Triton, and MQ-8B/C Hearth Scout. The corporate additionally gives content material on the F-35 and F/A-18.

Northrop Grumman reported outcomes for This autumn FY 2024 on January thirtieth, 2025. Firm-wide income was flat and diluted earnings per share rose to $8.66 from a lack of $3.54 on a year-over-year foundation.

Income for Aeronautics Programs rose 11% to $3,220M from $2,910M within the prior 12 months as a result of greater volumes in B-21, F-35 applications, and restricted applications.

Income for Protection Programs grew 5% to $2,333M from $2,231M in comparable quarters as a result of greater gross sales within the Sentinel and ammunition applications, offset by the completion of a global coaching program. Income for Mission Programs elevated 3%.

Click on right here to obtain our most up-to-date Positive Evaluation report on NOC (preview of web page 1 of three proven under):

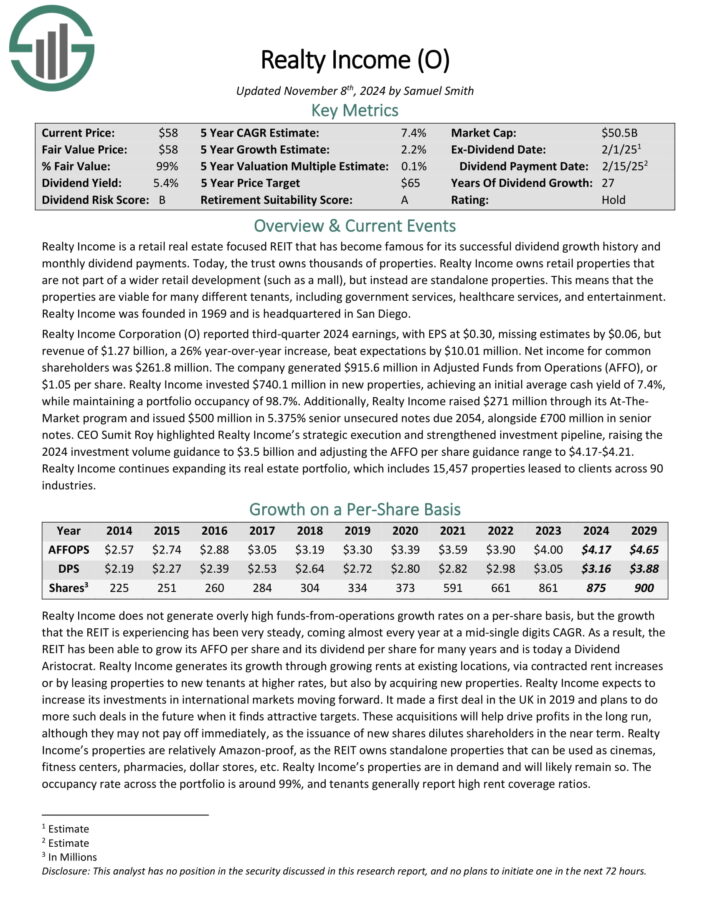

#11: Common Company (UVV)

5-year anticipated annual returns: 8.4%

Common Company is a market chief in supplying leaf tobacco and different plant-based inputs to client product producers.

The Tobacco Operations phase buys and sells tobacco used to make cigarettes, cigars, pipe tobacco, and smokeless merchandise.

Common buys tobacco from its suppliers, processes it, and sells it to massive tobacco corporations within the US and internationally.

Supply: Investor Presentation

The Ingredient Operations deal primarily with greens and fruits however is considerably smaller than the tobacco operations. Common has been rising this enterprise by acquisitions beginning in 2020.

Common Company reported its second quarter earnings outcomes on November 7. The corporate generated revenues of $710 million throughout the quarter.

Moreover, Common Company bought carryover crops throughout the interval, which added to the corporate’s income efficiency.

Click on right here to obtain our most up-to-date Positive Evaluation report on Common (preview of web page 1 of three proven under):

#10: S&P World (SPGI)

5-year anticipated annual returns: 8.7%

S&P World is a worldwide supplier of monetary providers and enterprise data and income of over $13 billion.

Via its numerous segments, it gives credit score rankings, benchmarks and indices, analytics, and different knowledge to commodity market individuals, capital markets, and automotive markets.

S&P World has paid dividends repeatedly since 1937 and has elevated its payout for 51 consecutive years.

S&P World posted third quarter earnings on October twenty fourth, 2024, and outcomes had been fairly sturdy as soon as once more. Adjusted earnings-per-share got here to $3.89, which was 25 cents forward of estimates. Earnings had been down from $4.04 in Q2, however a lot greater than $3.21 within the year-ago interval.

Income soared 16% greater year-on-year to $3.58 billion, which additionally beat estimates by $150 million. Development within the Scores and Indices phase led the highest line greater in Q3, though energy was broad.

Click on right here to obtain our most up-to-date Positive Evaluation report on SPGI (preview of web page 1 of three proven under):

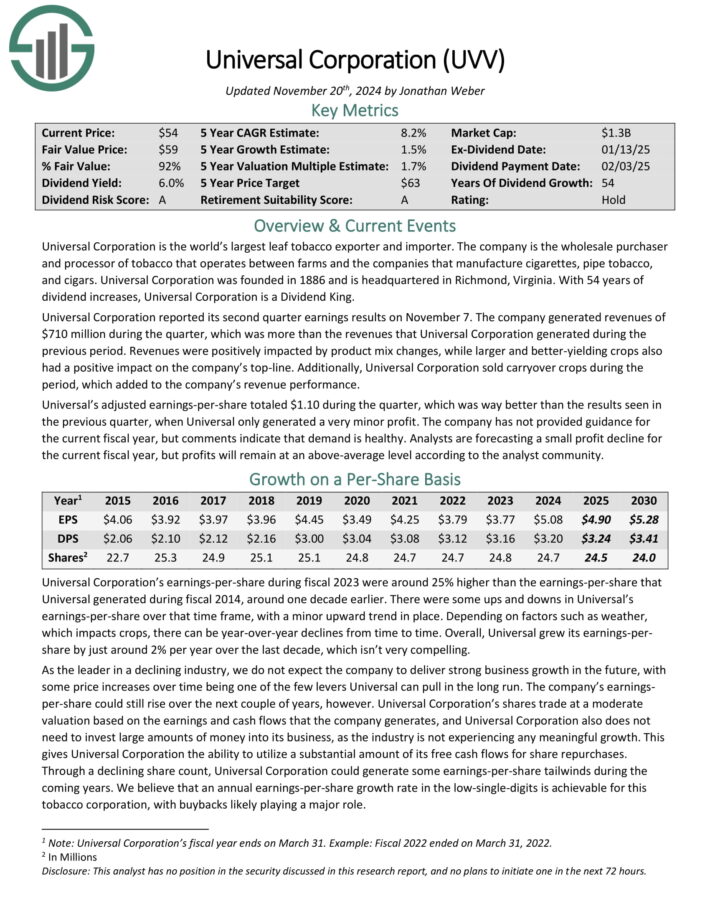

#9: Realty Earnings (O)

5-year anticipated annual returns: 8.8%

Realty Earnings is a retail actual property targeted REIT that has develop into well-known for its profitable dividend development historical past and month-to-month dividend funds.

Realty Earnings owns retail properties that aren’t a part of a wider retail improvement (corresponding to a mall), however as an alternative are standalone properties. Because of this the properties are viable for a lot of completely different tenants, together with authorities providers, healthcare providers, and leisure.

Realty Earnings reported third-quarter 2024 earnings, with EPS at $0.30, lacking estimates by $0.06, however income of $1.27 billion, a 26% year-over-year improve, beat expectations by $10.01 million. Web revenue for frequent shareholders was $261.8 million.

The corporate generated $915.6 million in Adjusted Funds from Operations (AFFO), or $1.05 per share. Realty Earnings invested $740.1 million in new properties, attaining an preliminary common money yield of seven.4%, whereas sustaining a portfolio occupancy of 98.7%.

Click on right here to obtain our most up-to-date Positive Evaluation report on Realty Earnings (preview of web page 1 of three proven under):

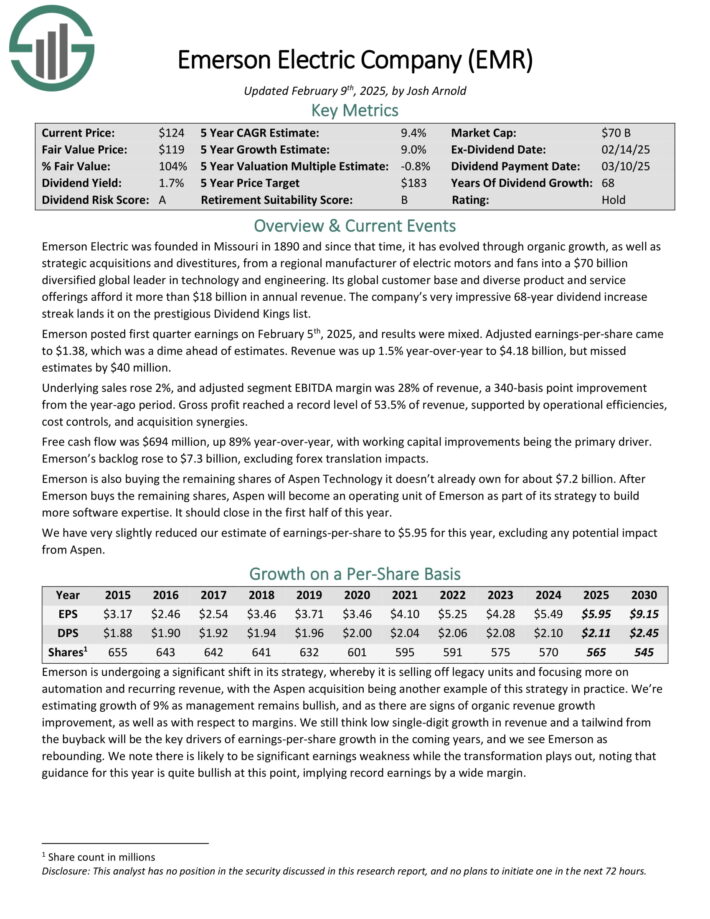

#8: Emerson Electrical (EMR)

5-year anticipated annual returns: 9.4%

Emerson Electrical is a diversified international chief in expertise and engineering. Its international buyer base and numerous product and repair choices afford it greater than $17 billion in annual income.

Emerson posted first quarter earnings on February fifth, 2025, and outcomes had been blended. Adjusted earnings-per-share got here to $1.38, which was a dime forward of estimates. Income was up 1.5% year-over-year to $4.18 billion, however missed estimates by $40 million.

Underlying gross sales rose 2%, and adjusted phase EBITDA margin was 28% of income, a 340-basis level enchancment from the year-ago interval. Gross revenue reached a document stage of 53.5% of income, supported by operational efficiencies, price controls, and acquisition synergies.

Free money circulation was $694 million, up 89% year-over-year, with working capital enhancements being the first driver. Emerson’s backlog rose to $7.3 billion, excluding foreign exchange translation impacts.

Click on right here to obtain our most up-to-date Positive Evaluation report on EMR (preview of web page 1 of three proven under):

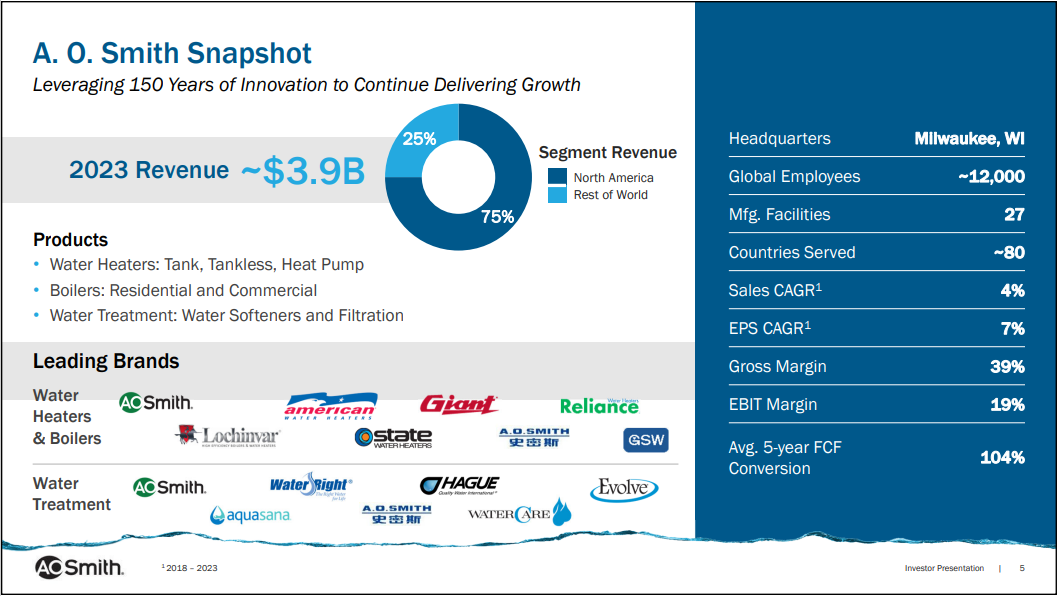

#7: A.O. Smith (AOS)

5-year anticipated annual returns: 10.0%

A.O. Smith is a number one producer of residential and business water heaters, boilers and water treatmentproducts. It generates two-thirds of its gross sales in North America, and a lot of the relaxation in China.

A.O. Smith has raised its dividend for 30 years in a row, making the corporate a Dividend Aristocrat. The corporate was based in 1874 and is headquartered in Milwaukee, WI.

A.O. Smith reported its third quarter earnings outcomes on October 22. The corporate generated revenues of $903 million throughout the quarter, which represents a decline of 4% in comparison with the prior 12 months’s quarter.

Income declined by 1% in North America, however the worldwide enterprise noticed a wider decline, primarily as a result of decrease gross sales in China, which has a troubled actual property market.

A.O. Smith generated earnings-per-share of $0.82 throughout the third quarter, which was down 9% on a 12 months over 12 months foundation.

Click on right here to obtain our most up-to-date Positive Evaluation report on AOS (preview of web page 1 of three proven under):

#6: Polaris Inc. (PII)

5-year anticipated annual returns: 11.4%

Polaris designs, engineers, and manufactures snowmobiles, all-terrain automobiles (ATVs) and bikes. As well as, associated equipment and alternative elements are bought with these automobiles by sellers positioned all through the U.S.

The corporate operates underneath 30+ manufacturers together with Polaris, Ranger, RZR, Sportsman, Indian Bike, Slingshot and Transamerican Auto Components. The worldwide powersports maker, serving over 100 international locations, generated over $7 billion in gross sales in 2024.

On January twenty eighth, 2025, Polaris introduced fourth quarter and full 12 months outcomes for the interval ending December thirty first, 2024. For the quarter, income declined 23.6% to $1.75 billion, however this was $70 million greater than excepted.

Adjusted earnings-per-share of $0.92 in contrast very unfavorably to $1.98 within the prior 12 months, however topped estimates by $0.02. For the 12 months, income fell 19.7% to $7.12 billion whereas adjusted earnings-per-share of $3.25 was down from $9.16 in 2023.

Click on right here to obtain our most up-to-date Positive Evaluation report on PII (preview of web page 1 of three proven under):

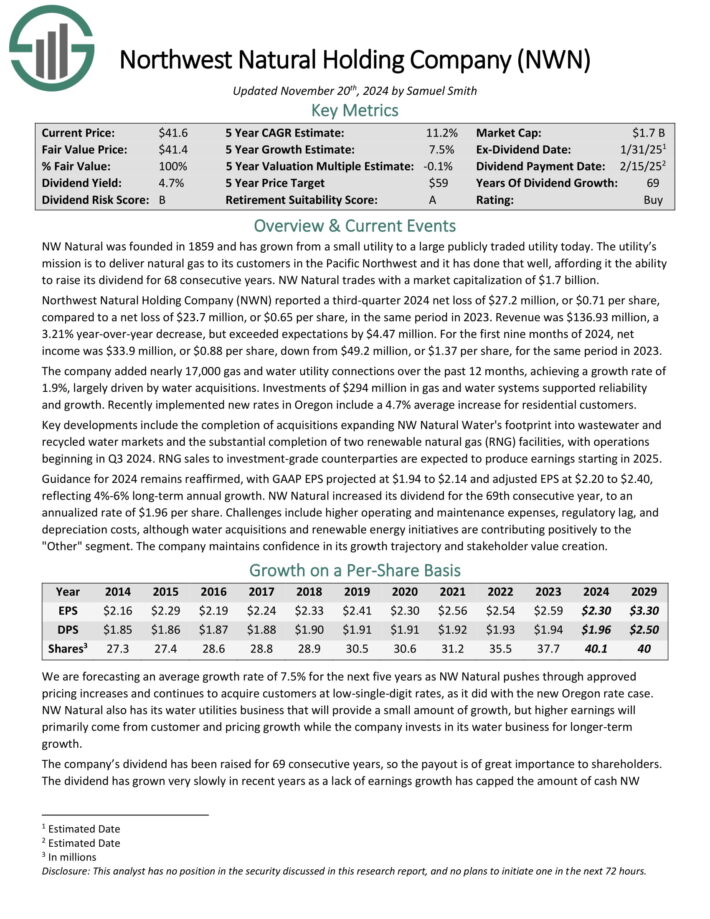

#5: Northwest Pure Fuel (NWN)

5-year anticipated annual returns: 11.6%

NW Pure was based in 1859 and has grown from only a handful of shoppers to serving greater than 760,000 immediately. The utility’s mission is to ship pure gasoline to its prospects within the Pacific Northwest.

The corporate’s areas served are proven within the picture under.

Supply: Investor Presentation

Northwest Pure Holding reported a third-quarter 2024 web lack of $27.2 million, or $0.71 per share, in comparison with a web lack of $23.7 million, or $0.65 per share, in the identical interval in 2023. Income was $136.93 million, a 3.21% year-over-year lower, however exceeded expectations by $4.47 million.

For the primary 9 months of 2024, web revenue was $33.9 million, or $0.88 per share, down from $49.2 million, or $1.37 per share, for a similar interval in 2023.

The corporate added almost 17,000 gasoline and water utility connections over the previous 12 months, attaining a development price of 1.9%, largely pushed by water acquisitions.

Investments of $294 million in gasoline and water methods supported reliability and development. Just lately carried out new charges in Oregon embrace a 4.7% common improve for residential prospects.

Click on right here to obtain our most up-to-date Positive Evaluation report on NWN (preview of web page 1 of three proven under):

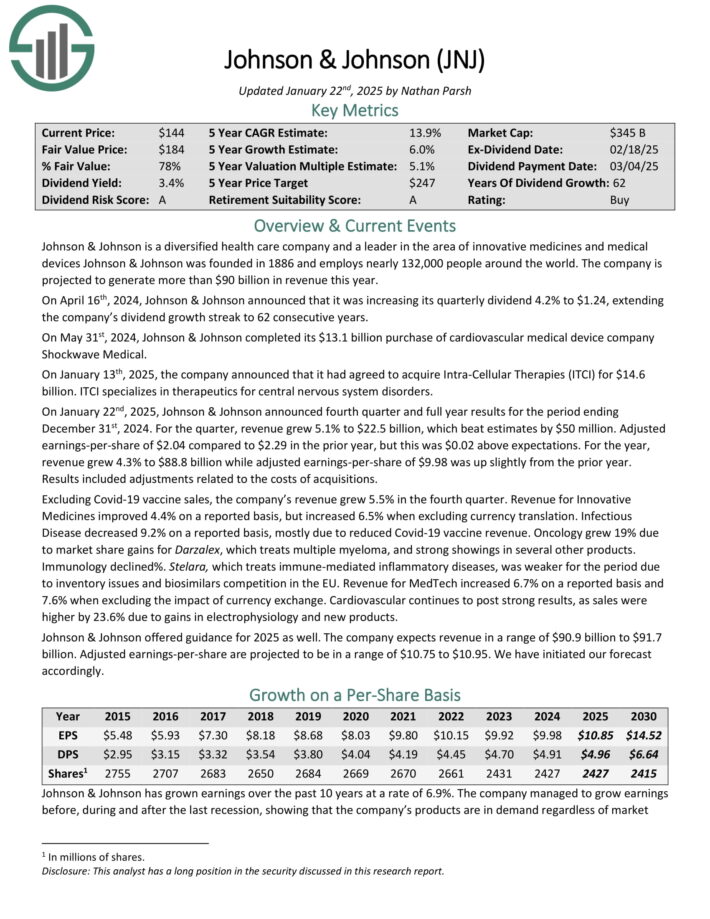

#4: Johnson & Johnson (JNJ)

5-year anticipated annual returns: 12.2%

Johnson & Johnson is a diversified well being care firm and a pacesetter within the space of modern medicines and medical gadgets Johnson & Johnson was based in 1886 and employs almost 132,000 folks world wide.

On January twenty second, 2025, Johnson & Johnson introduced fourth quarter and full 12 months outcomes for the interval ending December thirty first, 2024.

Supply: Investor Presentation

For the quarter, income grew 5.1% to $22.5 billion, which beat estimates by $50 million. Adjusted earnings-per-share of $2.04 in comparison with $2.29 within the prior 12 months, however this was $0.02 above expectations.

For the 12 months, income grew 4.3% to $88.8 billion whereas adjusted earnings-per-share of $9.98 was up barely from the prior 12 months. Outcomes included changes associated to the prices of acquisitions.

Click on right here to obtain our most up-to-date Positive Evaluation report on JNJ (preview of web page 1 of three proven under):

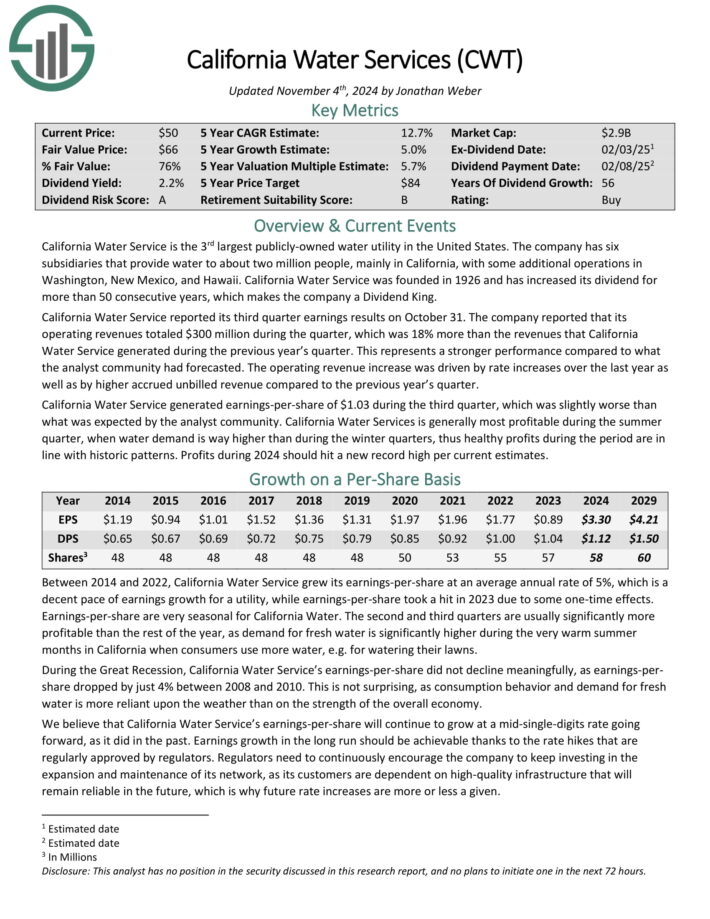

#3: Nordson Company (NDSN)

5-year anticipated annual returns: 13.7%

Nordson was based in 1954 in Amherst, Ohio by brothers Eric and Evan Nord, however the firm can hint its roots again to 1909 with the U.S. Computerized Firm.

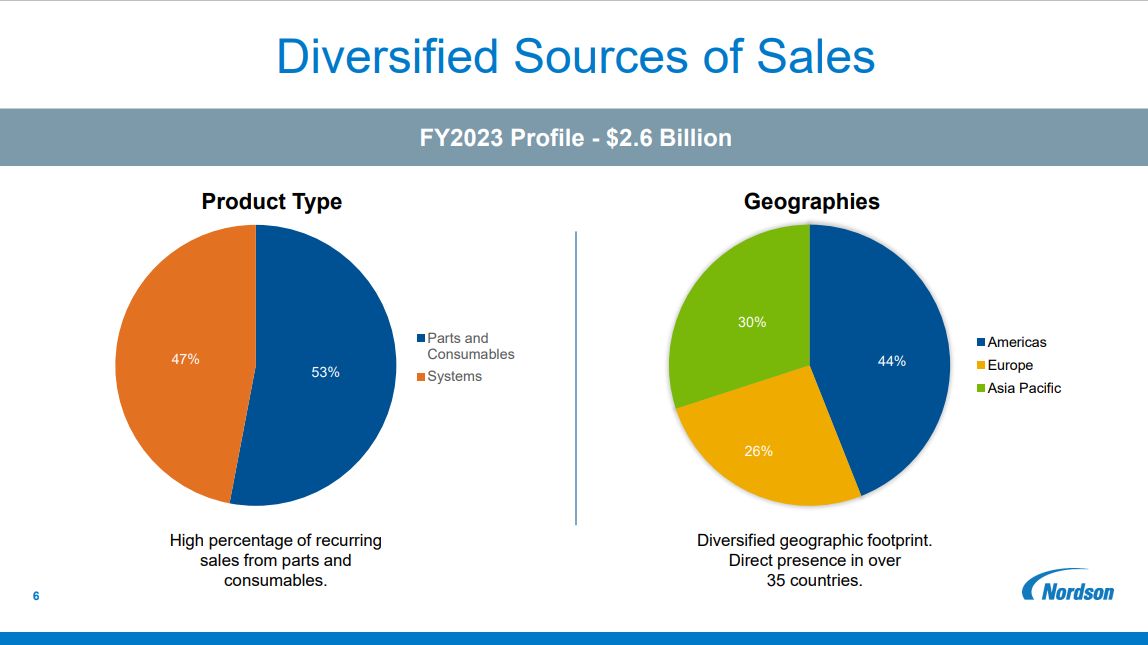

In the present day the corporate has operations in over 35 international locations and engineers, manufactures, and markets merchandise used for dishing out adhesives, coatings, sealants, biomaterials, plastics, and different supplies, with functions starting from diapers and straws to cell telephones and aerospace.

Supply: Investor Presentation

On August 14th, 2024, Nordson elevated its dividend by 15% to $0.78 per share quarterly, marking 61 years of will increase.

On December eleventh, 2024, Nordson reported fourth quarter outcomes for the interval ending October thirty first, 2024. For the quarter, the corporate reported gross sales of $744 million, 4% greater in comparison with $719 million in This autumn 2023, which was pushed by a optimistic acquisition influence, and offset by natural lower of three%.

Industrial Precision noticed gross sales lower by 3%, whereas the Medical and Fluid Options and Superior Know-how Options segments had gross sales will increase of 19% and 5%, respectively. The corporate generated adjusted earnings per share of $2.78, a 3% improve in comparison with the identical prior-year quarter.

Click on right here to obtain our most up-to-date Positive Evaluation report on NDSN (preview of web page 1 of three proven under):

#2: California Water Service Group (CWT)

5-year anticipated annual returns: 15.0%

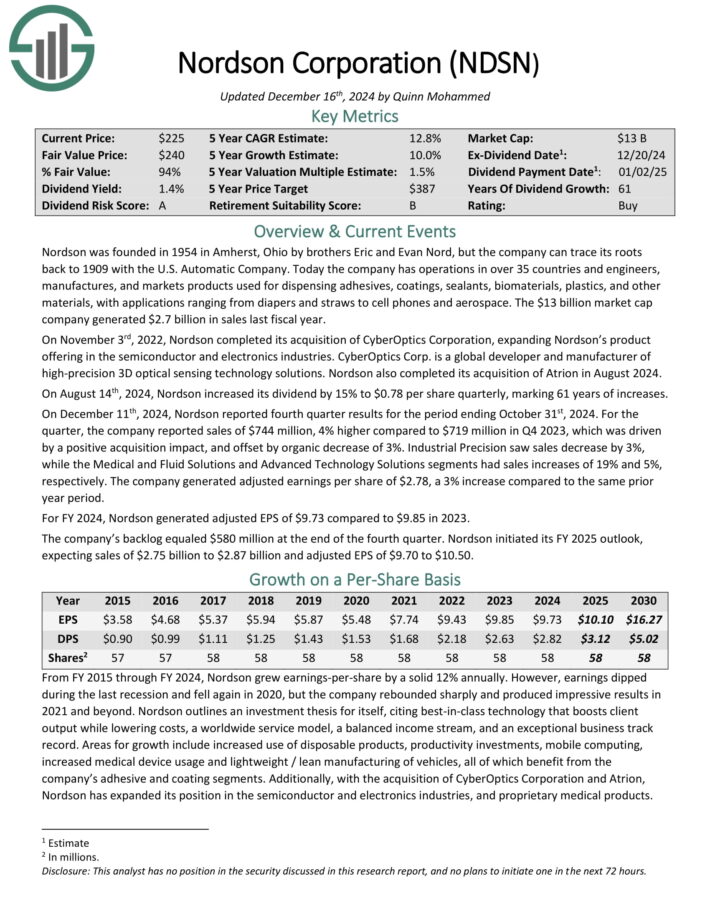

California Water Service is a water inventory and is the third-largest publicly-owned water utility in the US.

It was based in 1926 and has six subsidiaries that present water to roughly 2 million folks in 100 communities, primarily in California but in addition in Washington, New Mexico and Hawaii.

Supply: Investor Presentation

California Water Service reported its third quarter earnings outcomes on October thirty first. Working revenues totaled $300 million throughout the quarter, which was 18% greater than the identical quarter final 12 months.

This represents a stronger efficiency in comparison with what the analyst neighborhood had forecasted.

The working income improve was pushed by price will increase over the past 12 months in addition to by greater accrued unbilled income in comparison with the earlier 12 months’s quarter.

Click on right here to obtain our most up-to-date Positive Evaluation report on CWT (preview of web page 1 of three proven under):

#1: Hormel Meals (HRL)

5-year anticipated annual returns: 15.4%

Hormel Meals is a juggernaut within the meals merchandise business with almost $10 billion in annual income. It has a big portfolio of category-leading manufacturers. Only a few of its prime manufacturers embrace embrace Skippy, SPAM, Applegate, Justin’s, and greater than 30 others.

It has additionally pursued acquisitions to drive development. For instance, in 2021, Hormel acquired the Planters snack nuts enterprise from Kraft-Heinz (KHC) for $3.35 billion, which has boosted Hormel’s development.

Supply: Investor Presentation

Hormel posted fourth quarter and full-year earnings on December 4th, 2024, and outcomes had been in step with expectations. The corporate posted adjusted earnings-per-share of 42 cents, which met estimates. Income was off 2% year-on-year to $3.14 billion, additionally hitting estimates.

Working revenue was $308 million for the quarter on an adjusted foundation, or 9.8% of income. Working money circulation was $409 million for This autumn. For the 12 months, gross sales had been $11.9 billion, and adjusted working revenue was $1.1 billion, or 9.6% of income. Adjusted earnings-per-share was $1.58. Working money circulation hit a document of $1.3 billion.

Steering for 2025 was initiated at $11.9 billion to $12.2 billion in gross sales, with natural web gross sales development of 1% to three%.

Click on right here to obtain our most up-to-date Positive Evaluation report on HRL (preview of web page 1 of three proven under):

Ultimate Ideas and Extra Sources

Enrolling in DRIP shares may be a good way to compound your portfolio revenue over time. Extra assets are listed under for traders taken with additional analysis for DRIP shares.

For dividend development traders taken with DRIP shares, the 15 corporations talked about on this article are an important place to begin. Every enterprise may be very shareholder pleasant, as evidenced by their lengthy dividend histories and their willingness to supply traders no-fee DRIP shares.

At Positive Dividend, we regularly advocate for investing in corporations with a excessive likelihood of accelerating their dividends every 12 months.

If that technique appeals to you, it might be helpful to flick thru the next databases of dividend development shares:

The Dividend Kings Checklist is much more unique than the Dividend Aristocrats. It’s comprised of 54 shares with 50+ years of consecutive dividend will increase.

The Excessive Dividend Shares Checklist: shares that attraction to traders within the highest yields of 5% or extra.

The Month-to-month Dividend Shares Checklist: shares that pay dividends each month, for 12 dividend funds per 12 months.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.