Merchants, I sit up for sharing my ideas with you for the upcoming week.

First, my common ideas after a constructive week available in the market;

The market confirmed constructive motion final week, shrugging off detrimental headlines and reclaiming key short-term transferring averages just like the 5- and 20-day. The Zweig Breadth Thrust additionally triggered for simply the seventeenth time, with previous indicators resulting in a mean S&P achieve of 16.35% over six months and almost 24% over a 12 months. Constructive internals, worth motion above short-term transferring averages, and intraday power make a robust case for being bullish and internet lengthy; nevertheless, with ongoing commerce warfare uncertainty, I stay cautiously optimistic.

I’m not chasing new highs right here. As an alternative, I’m specializing in shares that confirmed relative power above their 200-day easy transferring averages (SMAs) throughout the correction and are organising with favorable risk-reward for potential second legs increased, if the market can base above its short-term transferring averages (MAs).

Right here’s an inventory of names I’ll be anticipating consolidation breakouts, together with a number of intraday setups. Endurance is essential: if the market holds above these transferring averages and affords a wholesome pullback or the next low, I’ll look to become involved.

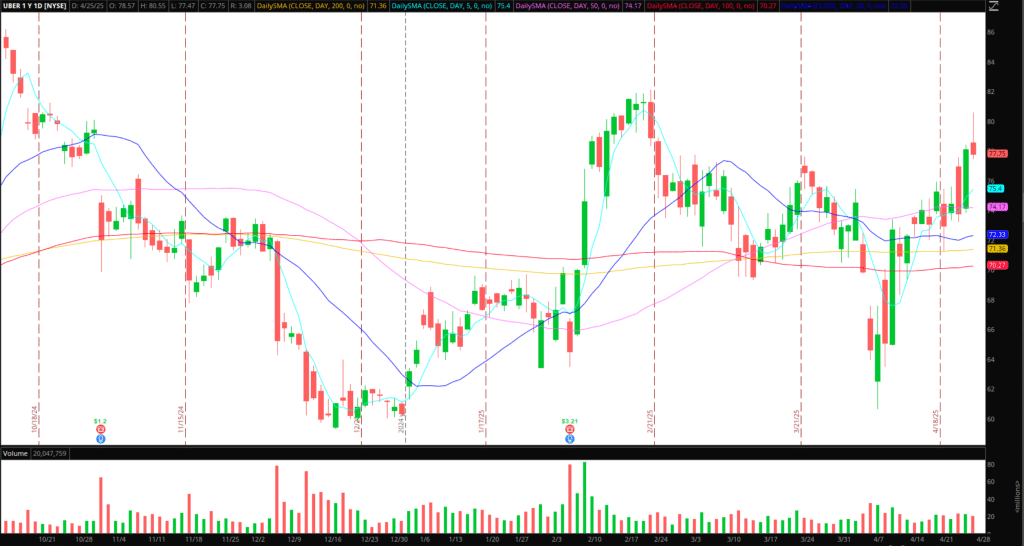

UBER: Proven spectacular outperformance for a number of components in current months and YTD. Not trying to chase the highs with the inventory approaching resistance on Friday. As an alternative, suppose the market proves itself within the coming days and weeks. In that case, I’ll be on the lookout for the next low towards $75, and a doable entry alternative on a pullback or consolidation breakout. Earnings are arising on Could 7.

*Please word that the costs and different statistics on this web page are hypothetical, and don’t replicate the influence, if any, of sure market components reminiscent of liquidity, slippage and commissions.

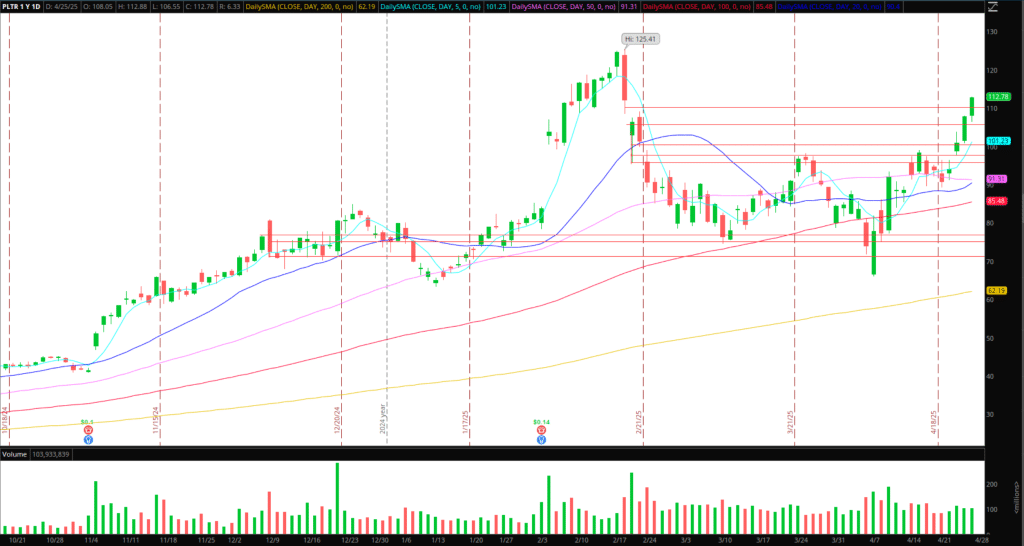

PLTR: Unimaginable relative power in current weeks, which hasn’t gone unnoticed. Earnings Could 5. Nothing to do proper now, however given the outperformance, one other inventory I’m anticipating the next low or consolidation with vary tightening, providing a skewed threat: reward for a breakout increased. But once more, it’s depending on continuation within the general market and relative power.

*Please word that the costs and different statistics on this web page are hypothetical, and don’t replicate the influence, if any, of sure market components reminiscent of liquidity, slippage and commissions.

HIMS: Earnings Could 5, and like all names talked about on the record, I wouldn’t be trying to maintain by earnings. HIMS is on my radar from a pure technical evaluation perspective. I just like the risk-reward supplied whereas the inventory consolidates at its 5-day, 20-day, and 200-day transferring averages. I’d be open to a protracted above final week’s excessive, with covers or provides, relying on the worth motion close to R1 $30. If we maintain above $30, I’d search for a goal of 1 ATR towards its 100-day transferring common close to $33, for a multi-day swing. With a LOD path.

*Please word that the costs and different statistics on this web page are hypothetical, and don’t replicate the influence, if any, of sure market components reminiscent of liquidity, slippage and commissions.

SPOT: Incredible relative power and, after all, tariff resiliency. Nothing to do proper now, given the transfer from sub-$500 to $ 620. The chance-reward isn’t there proper now. Nevertheless, if the inventory spends a number of days consolidating and tightening above $600, I’d search for a consolidation breakout to provoke a multi-day swing increased with a LOD path.

*Please word that the costs and different statistics on this web page are hypothetical, and don’t replicate the influence, if any, of sure market components reminiscent of liquidity, slippage and commissions.

OMEX: shifting gears to a small-cap now. Lastly, a pleasant multi-day, low-priced small-cap runner, part of the uncommon earth minerals theme. Good blowout on Friday within the $1.80s, adopted by some failed follow-through close to $1.6, and assist on day 2 within the $1.40s. For a place quick, I’d must see a push towards provide at $1.4 and fail to get quick for a sub-1 transfer. Alternatively, a $1.6 – $1.8 exhaust and fail to quick towards HOD for a transfer again towards the low 1s. If it consolidates on declining quantity over a few days, I’ll keep away from it.

*Please word that the costs and different statistics on this web page are hypothetical, and don’t replicate the influence, if any, of sure market components reminiscent of liquidity, slippage and commissions.

Extra large-caps on look ahead to continuation if the market continues to agency: AXON, TSLA, RKLB, CELH, TGTX, MELI, HOOD, RBLX, EAT, BSX.

Get the SMB Swing Buying and selling Analysis Template Right here!

Necessary Disclosures