Partially 1, we discovered the fundamentals of choice project.

On this half 2, we are going to proceed our studying journey into extra advanced eventualities of choice project.

Contents

Contemplate an investor promoting a bear name unfold on Costco (COST) with the brief name on the 15-delta.

Date: January 10, 2025

Worth: COST @ $927.50

Promote one Feb seventh COST $980 name @ $4.95Buy one Feb seventh COST $990 name @ $3.47

Credit score: $148

Earlier than putting the commerce, the investor calculates the max potential loss to be $852:

$1000 – $148 = $852

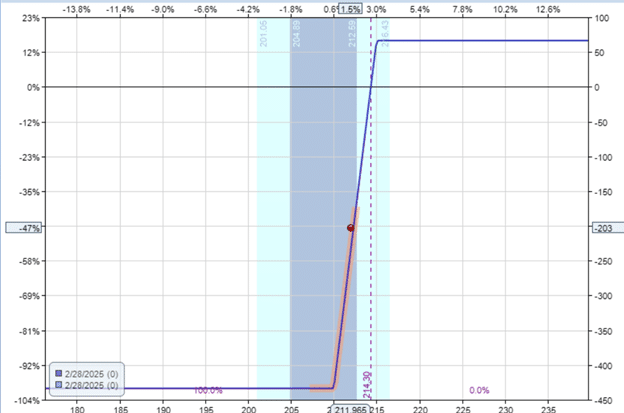

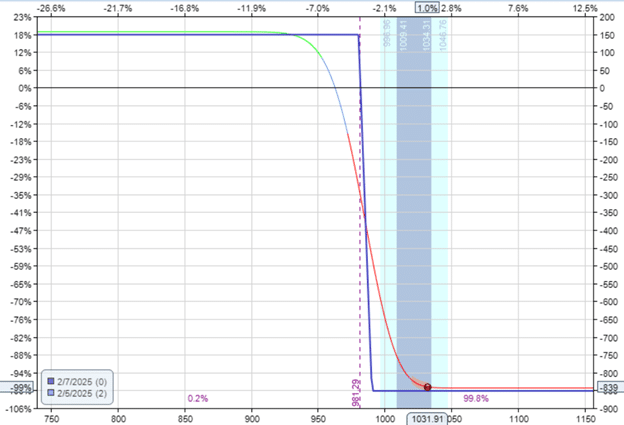

Costco’s worth went by an unimaginable rally and is up at $1032 on February 5 (two days earlier than expiration).

The bear name unfold is sort of at its max loss.

As luck would have it, the brief name with a strike of $980 is now assigned early.

The investor is compelled to promote 100 shares of Costco at $980 per share.

If the account doesn’t have already got 100 shares to promote, the investor leads to a short-stock place.

If the account isn’t allowed to brief shares of inventory or doesn’t have the margin to assist a brief inventory place of $98,000, the dealer might want to train the lengthy $990 name choice to purchase the 100 shares.

At the very least, that’s higher than shopping for on the market worth of $1032 per share.

Successfully, the investor buys at $990 per share to promote the shares at $980.

That may be a lack of $10 per share or a lack of $1000 for the 100 shares obligated by the one contract.

The web loss is just $852 should you account for the $148 preliminary credit score for initiating the bear name unfold.

This is identical max loss recognized at the beginning of the commerce.

If a brief name is assigned early, one other get together has exercised their lengthy name earlier than its expiration.

Why would the opposite get together try this?

They’re likelier to do this when their choices have little or no extrinsic worth.

Once they train their choice, they lose that extrinsic worth.

In our instance, on February 5, the $980 name choice (for which the opposite get together is lengthy) has a market worth of $52.73 per share.

This name choice is $52 within the cash as a result of $1032 – $980 = $52.

Due to this fact, the decision choice has solely $0.73 per share of extrinsic worth left.

By exercising their name choice, the opposite get together had given up the additional $73 to acquire the 100 shares of Costco now as a substitute of ready until expiration.

Costco has a dividend launch developing with an ex-dividend date of February 7.

That signifies that to obtain the dividend, an investor should purchase or personal the Costco inventory on February 6 or earlier than.

The dividend quantity is $1.16 per share or $116 for 100 shares.

So now we perceive why it is smart for the opposite get together to train early, giving up $0.73 per share to have the ability to obtain a dividend at $1.16 per share.

If they’d waited until expiration, they might not have been capable of obtain the dividend.

Whereas that is typically true almost at all times, it isn’t 100% true.

No rule or regulation says that solely ITM choices may be assigned.

Whereas this can be very uncommon, OTM choices may be assigned early.

Contemplate the case of a hypothetical investor who is brief the Costco $1060-strike name choice expiring on February 7, 2025.

On February 6, when Costco was buying and selling at $1052, he was assigned to a brief name that required him to promote 100 shares at $1060 per share.

He was assigned despite the fact that the decision choice was OTM (strike worth increased than the present inventory worth).

Assuming that he already had 100 shares of Costco (akin to in a coated name), that is excellent news for him.

He bought his 100 shares at $1060 per share when the market worth was $1052– a achieve of $8 per share.

This implies a lack of $8 per share for the opposite get together that exercised their lengthy name.

Why did they train their lengthy name choice when doing so whereas the choice is OTM, which ends up in a loss?

Maybe the opposite get together who owned the lengthy name made a mistake.

By way of a misunderstanding, they exercised their name choice to purchase at $1060 after they might purchase the inventory at the marketplace for $1052.

Extra probably was that the opposite get together noticed the Costco inventory worth at $1062 per share at 10:15 am Jap Commonplace Time.

This was when he referred to as his dealer to train his name choice to purchase at $1060 per share so he might personal 100 shares earlier than the ex-dividend date.

However after going by the automated cellphone prompts and reaching a dwell agent, it was ten minutes later, at 10:25 am, earlier than the decision choice obtained exercised.

By then, Costco inventory had dropped out-of-the-money to $1052 per share.

When you have a look at the intraday chart on February 7, it may be seen that this can be a actual risk.

So, usually, OTM choices aren’t exercised.

However in uncommon loopy eventualities, it will probably occur.

Now, we perceive that there’s a dividend incentive for early project of name choices.

Early project of put choices can and does occur additionally.

Right here is an instance of a bull put unfold on American Specific (AXP):

Date: February 21, 2025

Worth: AXP @ $303

Promote one March twenty first AXP $290 put @ $3.26Buy one March twenty first AXP $280 put @ $1.56

Credit score: $170

The max threat on this bull put unfold is $830.

The distinction between the strike worth and the premium acquired calculates this:

$1000 – $170 = $830

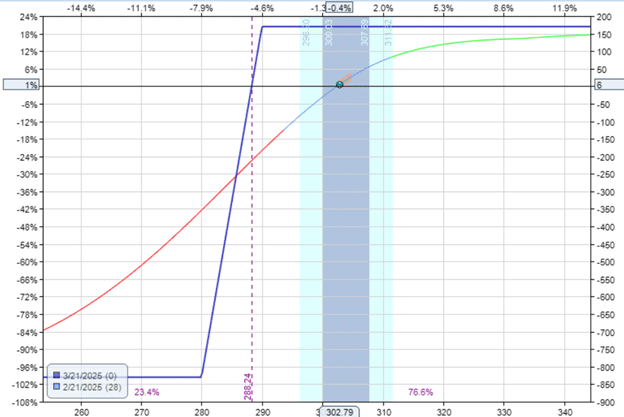

On the morning of March 15, with nonetheless another week until expiration, the worth of AXP is at $260. That’s fairly a drop.

Free Earnings Season Mastery eBook

The bull put unfold is ITM.

And the brief put with a strike of $290 is deep within the cash.

(For curious individuals, the delta on this brief put is a 97-delta).

As luck would have it, this investor is assigned 100 shares of AXP inventory.

That is an early project as a result of it’s nonetheless not but expiring.

Deep ITM choices have the next likelihood of being assigned.

And the nearer it will get to expiration, the possibilities enhance.

Early project occurs as a result of one other investor who holds the lengthy $290 put decides to train his proper to promote 100 shares of AXP at $290 per share.

Nicely, somebody has to purchase these shares from him.

That somebody is holding a brief $290 put with the identical expiration.

There are various such individuals.

So, the Choices Clearing Company (OCC) selects a brokerage, and the brokerage selects that somebody.

This choice may be random, lottery, round-robin, first-in-first-out, or different honest course of.

I stated, “As luck would have it,” this investor obtained assigned.

Okay, now what?

The investor wakes as much as see that he has 100 shares of AXP and $29,000 deducted from his account.

The max threat stays at $830 as a result of he nonetheless has the lengthy $280 protecting put choice (however just for another week).

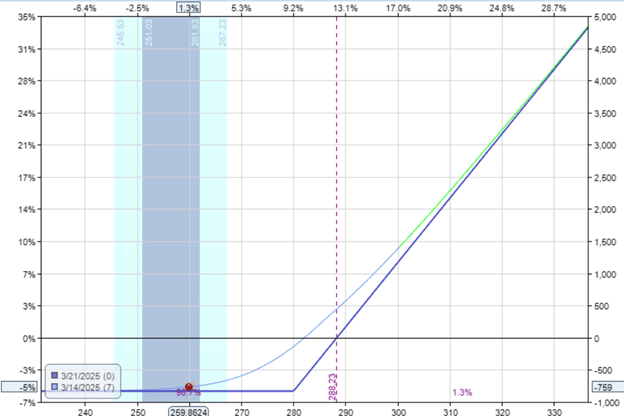

The 100 shares of AXP plus the lengthy put represents a married put place that appears like this…

We will see from the expiration graph that the danger on this place is $830 – the identical as the unique put credit score unfold threat.

At the moment, the investor can promote the 100 shares (at $260 per share), promote the lengthy put (for credit score of $2085), and take a web lack of $745 on the commerce.

Credit score for promoting the bull put unfold: $170

Buy of 100 shares of AXP at $290: -$29000

Promote 100 shares of AXP at $260: $26000

Promote the lengthy put: $2085

Internet loss in commerce: -$745

Or the investor can maintain the place.

If AXP goes up, he can get well somewhat little bit of the loss.

However holding the place ties up $29,000 value of capital.

If the investor holds the place until expiration and if AXP cannot go up above $280 per share, then the lengthy put will auto-exercise, promoting the 100 shares at $280 per share.

The ensuing web loss in commerce could be -$830, calculated as follows:

Credit score for promoting the bull put unfold: $170

Buy of 100 shares of AXP at $290: -$29000

Train lengthy put to promote AXP at $280: $28000

Max loss in commerce: -$830

If the account cannot assist the compelled buy of 100 shares of AXP, the dealer will pressure the train of the lengthy $280 put (even when it isn’t but expiring).

The outcome is identical calculation, leading to a max lack of $830.

However why did the opposite get together train their lengthy put choice early (which triggered our investor to be assigned to the brief put choice)?

Theoretically, the opposite get together has no monetary benefit in exercising the put choice early.

Let’s assume that the opposite get together has 100 shares of AXP, which they wish to promote at $290 per share or increased.

The opposite get together holding the lengthy $290 put ought to ideally maintain the put choice until expiration to see if the worth of AXP goes above $290.

If it does, then the funding would exceed $29,000 (first risk).

If it doesn’t, then the lengthy put is auto-exercised, giving the opposite get together $29,000 for the 100 shares (second risk).

By exercising early, the opposite get together relinquished the primary risk and instantly accepted the second risk.

It is a cheap selection because the possibilities of the primary risk occurring are low.

It’s unlikely that AXP will go from $260 again to above $290 within the one week that’s left.

The opposite get together frees the capital locked within the inventory by exercising the lengthy put choice to promote the shares.

The opposite get together could have private causes for needing this additional money instantly.

Sure, they will – however solely by early assignments.

If you consider the construction of the decision debit unfold and put debit unfold, for the brief choice to be ITM, the lengthy choice should already be ITM.

Due to this fact, the lengthy choice can at all times be exercised to cowl the brief choice at expiration.

If the brief choice is ITM at expiration, it signifies that the unfold has made its max potential revenue.

If the brief choice is ITM close to expiration, it signifies that the unfold has almost made its max potential revenue.

If early project occurs, it’s probably when the brief choice is ITM close to expiration for the explanations defined earlier.

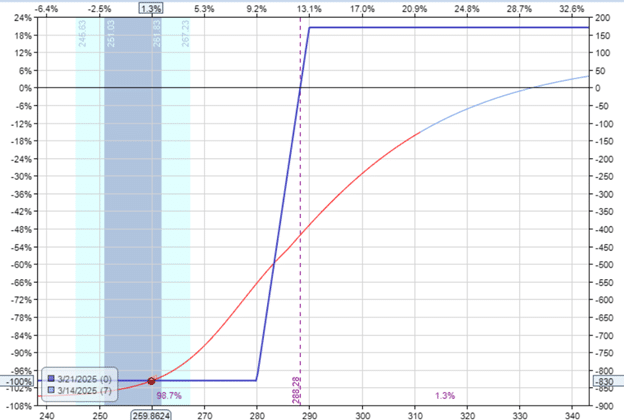

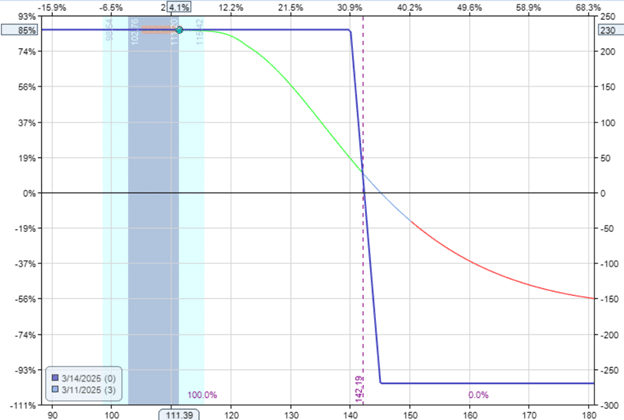

Contemplate the bear put debit unfold on NVIDIA (NVDA).

Date: Feb 18, 2025

Worth: NVDA at $140.83

Purchase one Mar 14 NVDA $145 put @ $10.55Sell one Mar 14 NVDA $140 put @ $7.85

Internet debit: -$270

On March 11, three days earlier than expiration:

The investor was assigned 100 shares of NVDA at $140 per share.

NVDA is buying and selling at $111.39 per share right now.

That will not sound good until you understand that the investor can now instantly train the lengthy $145 put choice to promote his 100 shares at $145 per share.

It is a revenue of $5 per share minus the debit paid for the unfold, which is a revenue of $230.

Alternatively, the investor can promote the 100 shares on the market worth of $111.39 and promote the lengthy put choice, which is valued at $3367.

Debit paid for the unfold: -$270

Assigned 100 shares at $140: -$14,000

Promote 100 shares at market: $11,139

Promote lengthy put choice at $3,367

Internet revenue: $236

That $6 of additional revenue comes from the additional intrinsic worth of the lengthy put choice.

Nonetheless, you may lose as a lot from slippage attempting to commerce out of the inventory and the put choice.

Or the investor can maintain the 100 shares till the expiration of the lengthy put choice.

If NVDA finally ends up under $145 at expiration, the lengthy put will auto-exercise to promote these shares at $145, leading to a web revenue of $230.

If NVDA is above $145 at expiration, the investor can promote it at that increased worth for an excellent higher revenue.

Maybe that is greater than you wanted or needed to find out about choices assignments.

So don’t fear should you don’t perceive every part straight away.

A few of these advanced eventualities require entering into the minds of the opposite get together to grasp why brief choices may be assigned early.

We hope you loved this text on choice project.

When you have any questions, ship an e mail or depart a remark under.

Lined Name Calculator Obtain

Disclaimer: The knowledge above is for instructional functions solely and shouldn’t be handled as funding recommendation. The technique introduced wouldn’t be appropriate for buyers who aren’t accustomed to alternate traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.