What Is the Lipstick Index?

The Lipstick Index is a time period coined by Leonard Lauder, former chairman of Estée Lauder, in the course of the early 2000s recession. It describes the phenomenon the place customers, throughout financial downturns, go for inexpensive luxuries like lipstick as a substitute of dearer objects. This conduct means that even in powerful occasions, folks search minor indulgences to spice up morale.

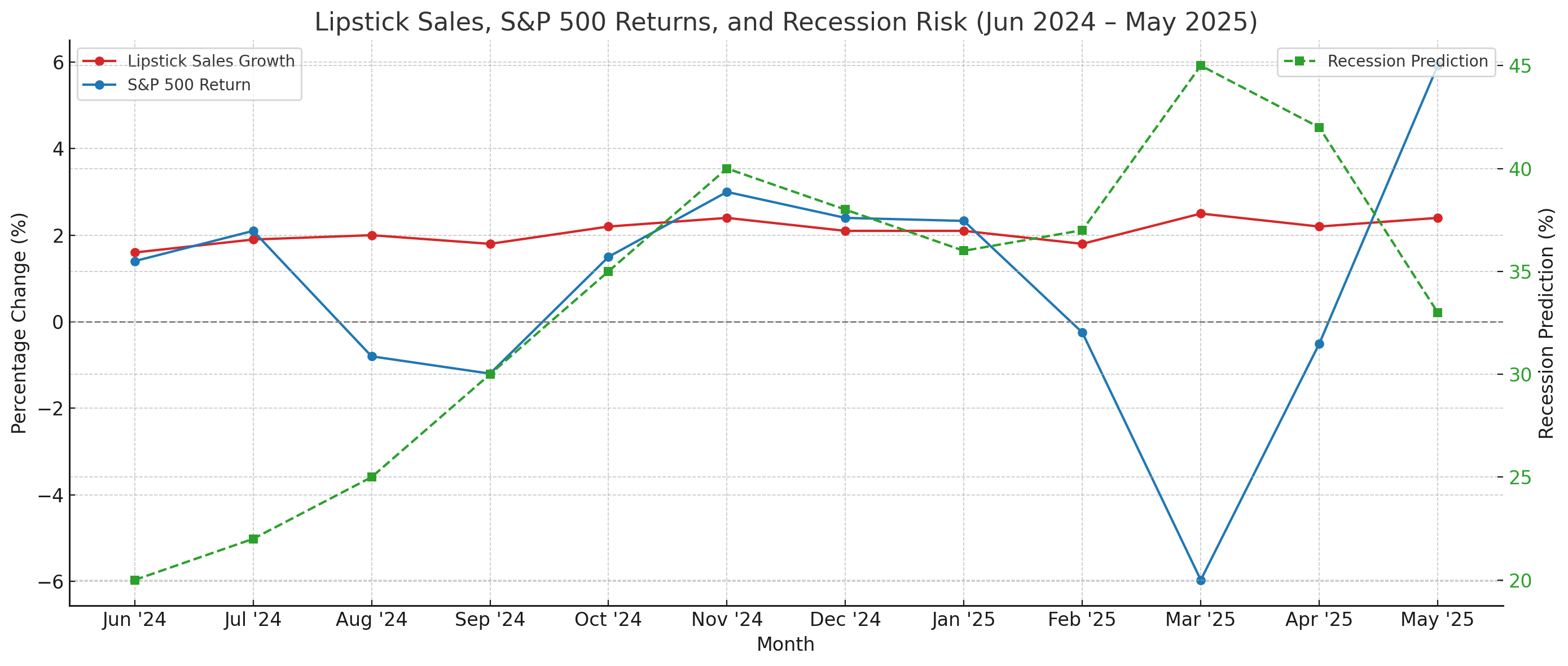

Lipstick Gross sales vs. Market Efficiency: June 2024–Might 2025

Analyzing the interval from June 2024 to Might 2025 reveals intriguing traits:

Lipstick gross sales skilled constant development, averaging round 2% month-over-month will increase.

The S&P 500 displayed volatility, with notable declines in March (-5.97%) and April (-0.51%) 2025, earlier than rebounding in Might (+5.92%).

Recession prediction fashions peaked in March 2025 at a forty five% chance, indicating heightened financial uncertainty.

This divergence means that whereas investor confidence wavered, shopper spending on small luxuries remained resilient.

The Lipstick Index in Motion: Visualizing the Information

Key Observations:

March 2025: As recession danger peaked and the S&P 500 declined sharply, lipstick gross sales development remained optimistic. Even a really small improve in gross sales on the backside of the market

April–Might 2025: Regardless of market volatility, lipstick gross sales continued their upward pattern, highlighting shopper inclination in direction of inexpensive indulgences throughout unsure occasions.

Michael Burry’s Strategic Shift: Doubling Down on Estée Lauder

In a notable transfer, Michael Burry, famend for predicting the 2008 monetary disaster, has restructured his funding portfolio:

Scion Asset Administration, Burry’s agency, doubled its stake in Estée Lauder, buying 200,000 shares valued at roughly $13.2 million, in line with their newest 13F submitting

Concurrently, Burry liquidated most of his different holdings, together with vital positions in Chinese language tech firms, and initiated bearish bets in opposition to corporations like Nvidia .

This concentrated funding suggests Burry’s confidence in Estée Lauder’s potential resilience amid financial downturns.

Decoding Burry’s Transfer: A Guess on the Lipstick Index?

Burry’s deal with Estée Lauder aligns with the rules of the Lipstick Index:

Client Habits: Even throughout financial hardships, customers are likely to take pleasure in small luxuries, akin to cosmetics.

Market Resilience: The wonder business, significantly firms like Estée Lauder, typically demonstrates stability throughout market downturns.

By investing closely in Estée Lauder, Burry seems to be banking on the enduring demand for inexpensive luxuries, whilst broader markets face volatility.

Funding & Advertising and marketing Implications

For Traders:

Estée Lauder (EL) and related magnificence firms could provide defensive funding alternatives throughout financial downturns.

Monitoring shopper conduct traits can present insights into resilient sectors.

Limitations of the Lipstick Index

Whereas the Lipstick Index presents useful insights, it’s important to think about its limitations:

Evolving Client Preferences: Shifts in direction of skincare and wellness merchandise could affect conventional lipstick gross sales. So whereas it is probably not simply Lipstick going up, however different “worth” or inexpensive and really feel good objects. As an alternative of the $200 fragrance, it’s the $20 eye shadow.

International Market Dynamics: Components like provide chain disruptions and geopolitical tensions can impression the wonder business.

Closing Ideas

The convergence of constant lipstick gross sales development, market volatility, and Michael Burry’s strategic funding in Estée Lauder underscores the relevance of the Lipstick Index in 2025. As customers proceed to hunt consolation in small luxuries, and buyers regulate their portfolios accordingly, the wonder business stays a focus in understanding financial and shopper conduct traits.

Learn Subsequent: Why is the US Greenback Shedding Worth?

Hey there! I’m Russ Amy, right here at IU I dive into all issues cash, tech, and infrequently, music, or different pursuits and the way they relate to investments. Approach again in 2008, I began exploring the world of investing when the monetary scene was fairly rocky. It was a tricky time to begin, nevertheless it taught me masses about how you can be good with cash and investments.

I’m into shares, choices, and the thrilling world of cryptocurrencies. Plus, I can’t get sufficient of the most recent tech devices and traits. I consider that staying up to date with know-how is essential for anybody desirous about making smart funding decisions as we speak.

Expertise is altering our world by the minute, from blockchain revolutionizing how cash strikes round to synthetic intelligence reshaping jobs. I feel it’s essential to maintain up with these adjustments, or danger being left behind.