On this article, we’re speaking about promoting put choices for earnings technology relatively than for buying inventory.

Contents

Traders generate earnings by gathering premiums for promoting put choices with a strike worth beneath the present inventory worth, anticipating that the inventory won’t come all the way down to the strike worth earlier than expiration of the choice.

An investor can commerce this technique conservatively or aggressively.

That is decided by the strike worth and the way far it’s beneath the present inventory worth.

If the strike worth could be very far beneath the inventory worth, then there’s a decrease chance that the inventory will ever drop to the strike worth.

Due to this fact, this can be a conservative option to commerce it.

For a extra aggressive investor who desires to gather a bigger premium, the strike worth is nearer to the inventory worth.

On this case, there’s a greater likelihood that the inventory would possibly drop beneath the strike worth at choice expiration.

If that had been to occur, the investor is obligated to purchase the inventory on the strike worth.

It’s stated that the investor is “assigned” the inventory.

The investor doesn’t wish to be assigned the inventory for earnings technology.

They simply wish to accumulate the premium, letting the choice contract that they offered expire nugatory.

In sure account varieties, the dealer would require that the investor have sufficient free money accessible to buy 100 shares of the inventory for each one put choice contract offered.

When an investor sells put choices with sufficient money on the sidelines, this is called promoting “cash-secured places”.

How far beneath the inventory worth to set the strike worth is subjective.

“How far” is a relative time period.

A strike worth that’s 10 factors beneath the inventory worth in a $30 inventory has a distinct danger than a 10-point distance in a $150 inventory.

As well as, it additionally is determined by how distant the choice’s expiration is.

A greater option to quantify this danger in a comparable comparability is to have a look at the delta of the strike worth.

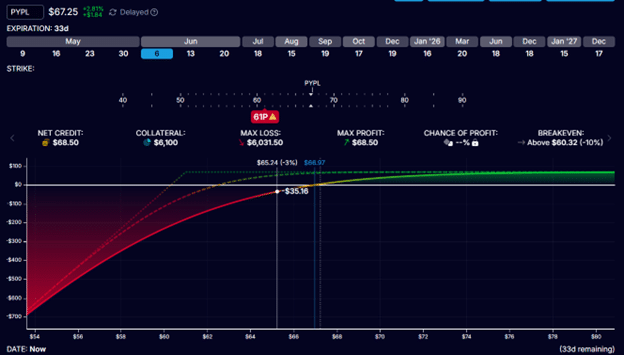

Suppose an investor sells a put choice on PayPal (PYPL) that’s a couple of month until expiration.

Paypal is buying and selling at $67.25 on the shut of Could third, 2025.

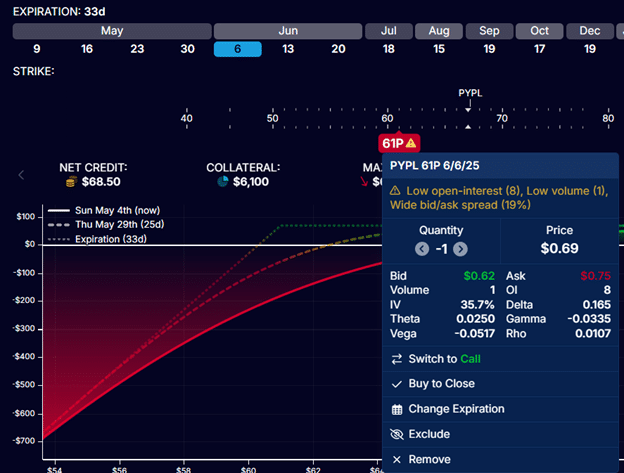

The investor sells the put choice with the $61 strike worth expiring on June sixth, 33 days away.

If we glance nearer at this feature, we see that it has a delta of 0.165:

We merely say that this put choice is at a “delta of 16”.

The decrease the strike worth, the decrease this delta.

The nearer the strike worth is to the inventory worth, the upper the delta.

You may see for your self as you slide the put choice up and down in OptionStrat.

Free Earnings Season Mastery eBook

A delta of 16 means there’s a couple of 16% likelihood that PYPL might be at or beneath the strike worth at expiration.

By the way, the worth of this 16-delta is the one-standard-deviation anticipated transfer of PYPL from now to expiration.

However we received’t fear about this matter for this dialogue.

By promoting the $61-strike put choice, the investor collects a $68.50 credit score.

This commerce ties up $6100 of the investor’s capital as a result of he has to have this a lot money available within the occasion of task to buy 100 shares of inventory at $61 per share.

A most potential revenue of $68.50 on $6100 of capital held is a 1% return on funding in a single month.

$68.50 / $6100 = 1%

The speed of earnings technology for this commerce is roughly 1% monthly.

Or a 12% annualized return on capital.

That is assuming that every of the choices expires nugatory at expiration.

The return is likely to be barely decrease if there are any inventory assignments, taking income earlier, and so on.

This was a conservative put promoting instance.

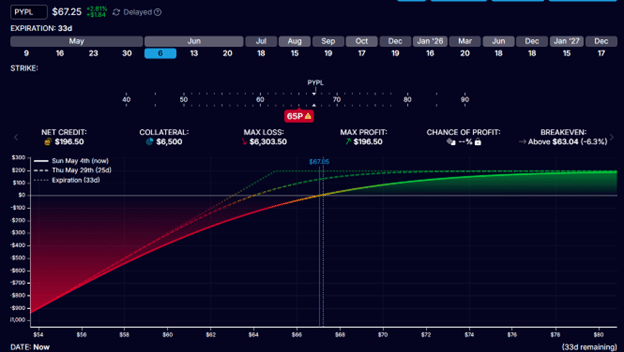

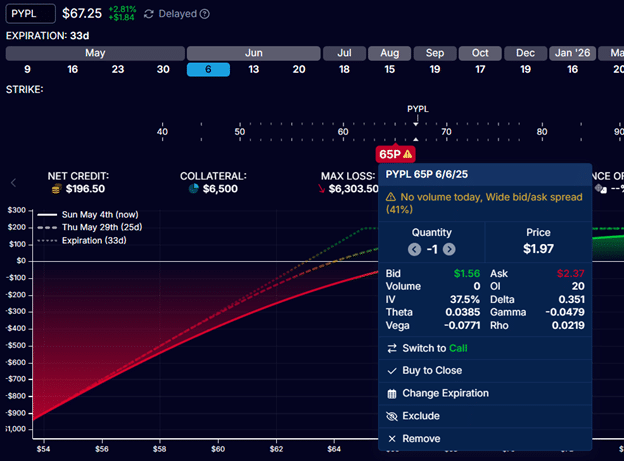

For a extra aggressive put promoting instance, the investor would possibly promote the put choice with the $65 strike, identical PYPL inventory on the identical June sixth expiration.

This fashion, the investor collects a bigger credit score of $196.50.

However he must put up $6500 of capital within the occasion that he wants to purchase 100 shares at $65 per share.

So the return on capital for this commerce is:

$196.50 / $6500 = 3%

A 3% return monthly, or 36% annualized, can be an aggressive put-selling instance.

The $65 put choice is on the 35-delta:

There’s a couple of 35% likelihood that PYPL might be beneath the strike worth at expiration, and the investor must purchase 100 shares.

To be exact, the capital in danger within the final instance is $6303.50.

If an investor buys 100 shares for a complete of $6500 and PayPal goes to zero, he would solely lose $6303.50 (versus $6500) since he had collected the additional $196.50 credit score upfront.

Whether or not you calculate the return primarily based on true capital in danger:

$196.50 / $6303.50 = 3.12%

Or whether or not you employ a simplified calculation:

$196.50 / $6500 = 3.02%

The distinction isn’t a lot.

It’s possible you’ll be promoting put choices for earnings technology.

On the whole, a 1% month-to-month return is conservative, and a 3% month-to-month return is aggressive.

Promoting on the 16-delta is conservative, and promoting on the 35-delta is extra aggressive.

What’s conservative for one investor could also be aggressive for an additional investor, and vice versa.

And a few traders will promote much more conservatively.

And a few traders intention much more aggressively at 4% monthly.

Now you realize whether or not your strategies are thought of conservative or aggressive.

We hope you loved this text on how conservative or aggressive your put choices promoting is.

If in case you have any questions, ship an e mail or go away a remark beneath.

Commerce secure!

Disclaimer: The knowledge above is for academic functions solely and shouldn’t be handled as funding recommendation. The technique introduced wouldn’t be appropriate for traders who aren’t acquainted with alternate traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.