Within the choices market, there are alternatives sellers and choices consumers.

What’s a win for the choice vendor is a loss for the choice purchaser, and vice versa.

Contents

The choice sellers will reap the best reward if all of the choices they promote expire nugatory.

In that situation, the consumers’ choices would turn into nugatory, inflicting them to lose each cent they paid.

This situation is an instance of an excessive case.

The max ache concept means that market forces will are inclined to drive the underlying inventory’s worth in direction of this situation.

The max ache worth is the strike worth at expiration, the place choices consumers would lose essentially the most cash based mostly on the focus of open calls and put choices contracts.

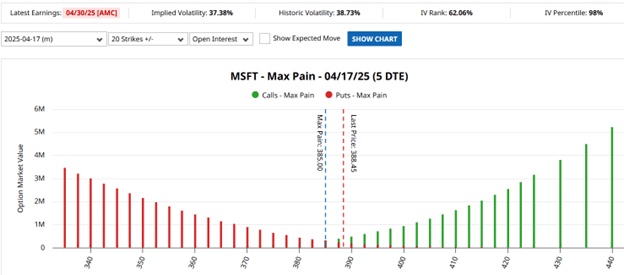

We will see barchart.com exhibiting Max Ache calculation for Microsoft (MSFT) for the April 17, 2025 month-to-month expiration.

The choice expiration is 5 days away, as denoted by “5 DTE” (days to expiration).

It reveals that the present worth of MSFT is $388.45, and the max ache worth is the $385 strike worth.

The purple bars symbolize put choices worth; the inexperienced bars symbolize name choices.

The Max Ache is the worth the place the choice values are the bottom if MSFT had been to run out at that worth.

In keeping with the Max Ache concept, the market forces will try to maneuver the MSFT worth down from $388.45 to $385 within the 4 days left till expiration.

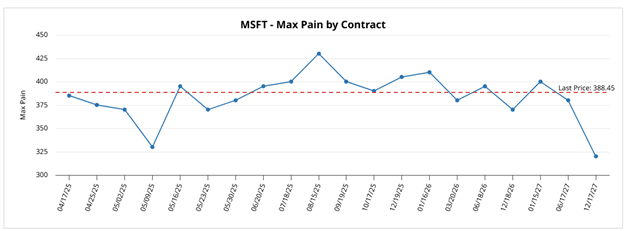

Keep in mind that the Max Ache worth adjustments day by day as new choices open and shut.

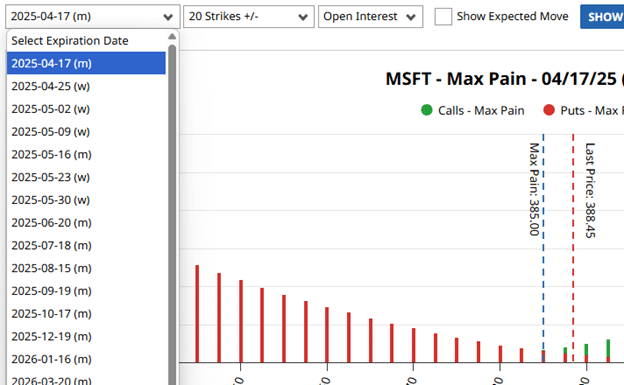

The Max Ache worth can be totally different for various expiration cycles.

You possibly can choose from the dropdown menu which expiration cycle you need Barchart to compute the Max Ache for.

Entry The Prime 5 Instruments For Choice Merchants

As a substitute of choosing every of the expirations to find out its Max Ache, we will scroll additional down the web page, and Barchart has plotted its calculated Max Ache worth for the assorted expiration cycles:

The Max Ache idea helps us perceive how the choices market can affect the worth of a inventory close to expiration.

Choices market makers want to jot down (promote) contracts based mostly on the calls for of choices consumers.

Not eager to take these directional positions, the market makers hedge their choices positions by shopping for or promoting shares of the inventory.

This hedging exercise is believed to make a inventory worth gravitate to the Max Ache worth.

After all, this magnetic pull isn’t a assure of worth motion.

Vital information occasions, an organization incomes bulletins, a robust market sentiment development on the inventory, or different components can simply override it.

Max Ache is much less dependable for thinly traded shares.

Apply them solely to shares with excessive choice quantity and open curiosity.

Max Ache is especially a software for the short-term thesis throughout expiration week and is much less helpful for longer-term trades.

Subsequently, one mustn’t solely commerce based mostly on Max Ache concept alone however might use it along with different technical evaluation indicators comparable to worth help and resistance ranges and, development strains, and many others.

We hope you loved this text on the max ache idea of choices expiration.

When you’ve got any questions, ship an e-mail or go away a remark beneath.

Commerce protected!

Disclaimer: The data above is for instructional functions solely and shouldn’t be handled as funding recommendation. The technique offered wouldn’t be appropriate for buyers who should not aware of change traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.