Angel Oak Mortgage REIT eked out a revenue within the second quarter however missed Wall Road expectations partially attributable to a observe providing.

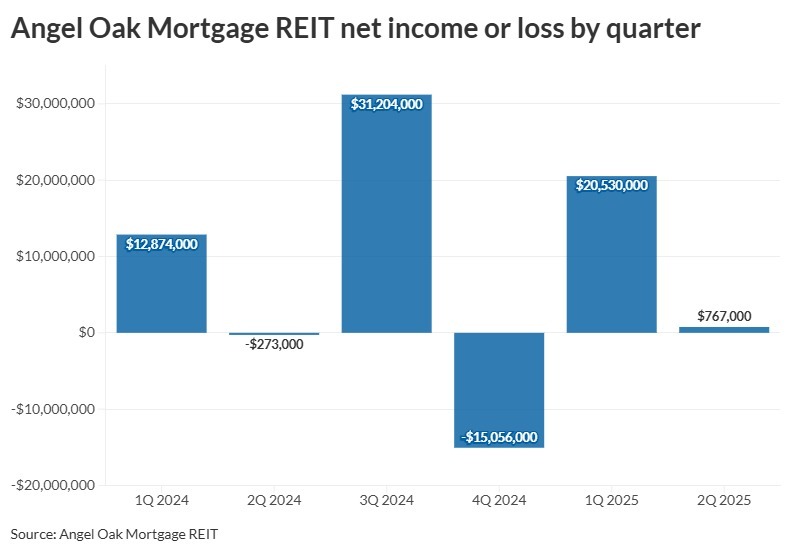

The non-qualified mortgage participant Tuesday reported web earnings of $767,000 for the interval, properly beneath an S&P Capital IQ consensus imply estimate of $6.34 million. The true property funding belief’s quarterly outcomes have see-sawed in latest quarters, from a $273,000 loss the identical time a yr in the past, to a $20.5 million revenue on the finish of March.

Angel Oak’s busy spring included two securitizations and the acquisition of $147 million in loans together with house fairness strains of credit score. The corporate in Might also closed a $42.5 million providing of 9.750% senior notes due 2030, and proceeds lined non-QM acquisitions and normal company functions.

The observe providing added to curiosity bills, and largely counterbalanced a 35% year-over-year enhance in curiosity earnings to $35 million. The agency’s $9.9 million in web curiosity earnings was comparatively flat in latest quarters.

Executives weigh non-QM exercise

Firm leaders in Tuesday morning’s earnings name mentioned securitization markets stay accretive regardless of bigger financial uncertainty. Extra mortgage REITs are additionally coming into the non-QM area and the competitors is wholesome, CEO Sreeni Prabhu steered.

“We’re not seeing that a lot creep in credit score requirements from even different guys,” he mentioned. “In order that’s additionally an excellent factor, proper, as a result of that is a worrisome development.”

Prabhu additionally mulled an analysts’ query on whether or not demand for hybrid adjustable-rate mortgages would emerge to refinance high-coupon debtors, if long-term charges stay elevated.

“I do suppose these conversations will occur if the longer charges keep greater and also you begin seeing the entrance finish, as a result of that surroundings hasn’t occurred in a very long time,” he mentioned. “However as of at this time, it is not environment friendly.”

Executives additionally weighed the influence of a future price lower by the Federal Reserve, after the central financial institution stood pat final week. Though Angel Oak famous a slight uptick in prepayment speeds up to now quarter, Treasurer and Chief Monetary Officer Brandon Filson mentioned he would not anticipate a lot motion in his firm’s portfolio.

“A lot of our portfolio can be nonetheless considerably underwater or out of the cash from a refinance choice on the 5% coupon vary,” he mentioned.

Angel Oak’s second quarter at a look

The REIT reported earnings per share of $0.03 within the second quarter, additionally lacking a consensus estimate of $0.27. Within the first quarter, that mark was $0.87; it was unfavourable $0.01 the identical time a yr in the past. The corporate additionally reported $1.6 million of unrealized loss on its securitized and residential portfolios.

Angel Oak accomplished two securitizations over the spring, which paid down a mixed $315.5 million in money owed and launched a mixed $33.9 million in money to buy new loans.

On the finish of June, the agency had an undrawn mortgage financing capability of $931 million. Its residential mortgage portfolio had a mean weighted coupon of 8.37%, up 82 foundation factors from the primary quarter and up 66 foundation factors from the identical time final yr.

The corporate additionally reported a falling delinquency price, with its whole portfolio weighted common proportion of loans 90 days or extra past-due falling 44 foundation factors from the primary quarter to 2.35%. Most of these enhancements got here from securitizations in 2023 and 2024, which had been poorer performers in earlier quarters.

The corporate’s inventory fell 7% Tuesday morning following the earnings releases, and sat round $8.75 a share by noon.